Wix.com Ltd. (NASDAQ:WIX) has shown resilience and growth potential in the tech sector, making it an attractive investment.

The company’s stock performance and financial indicators reflect its relevance and leadership in the website creation and management space.

With a target price of $172.15, analysts are optimistic about WIX’s future growth trajectory and financial health.

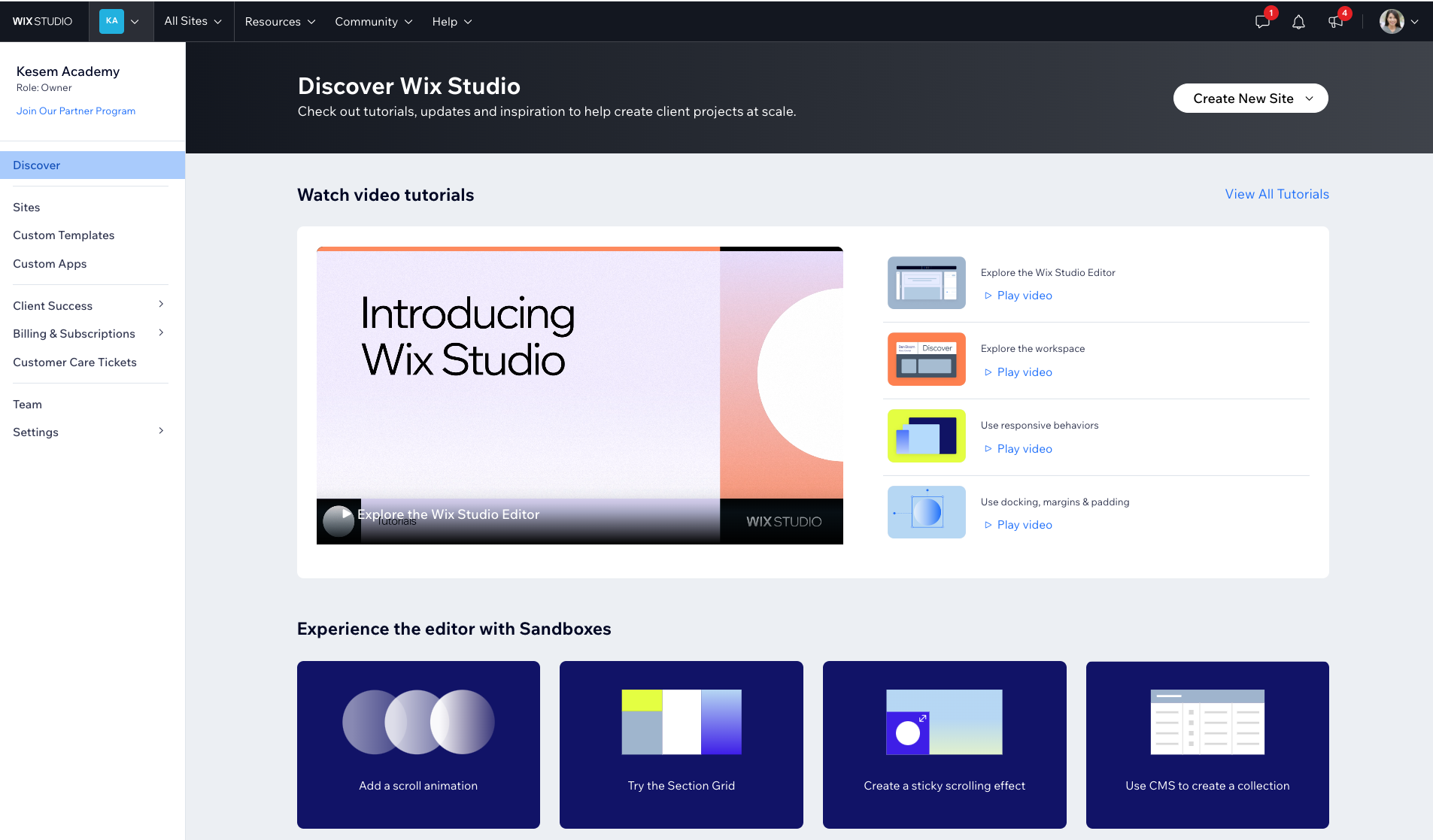

Wix.com Ltd. (NASDAQ:WIX) is a standout in the crowded field of website creation and management, offering a platform that enables users to design, manage, and grow their online presence with ease. As businesses and individuals increasingly move online, WIX’s services have become more relevant than ever, positioning the company at the forefront of digital transformation. This relevance is reflected in its stock performance and financial indicators, making it a top pick for investors looking for growth opportunities in the tech sector.

Over the last month, WIX has seen its stock price increase by 0.76%, signaling investor confidence in the company’s direction. Despite a recent 6.52% dip in the past 10 days, the broader perspective suggests that this could be a temporary setback rather than a long-term trend. Such fluctuations are not uncommon in the tech industry and can provide buying opportunities for those who are bullish on a company’s long-term prospects.

The growth potential of WIX is underscored by its impressive Piotroski Score of 8, which highlights the company’s financial robustness across critical areas such as profitability and liquidity. This score is significant because it suggest that WIX is not only growing but doing so in a financially healthy manner, which is crucial for sustaining long-term growth.

Analysts have set a target price for WIX at $172.15, which represents a considerable upside from its current trading level. This target is based on the company’s innovative platform, expanding user base, and strategic initiatives aimed at capturing a larger share of the online presence market. Such optimism from analysts often reflects a deep dive into the company’s operational and financial metrics, suggesting a strong belief in WIX’s growth trajectory.

WIX’s recent performance, marked by a short-term decline after steady gains, alongside its strong growth potential and financial health, makes it an attractive investment. The company’s leadership in the website creation and management space, coupled with its commitment to product enhancement and market expansion, provides a solid foundation for future growth. For investors looking at the tech sector, WIX offers a blend of short-term recovery potential and long-term growth prospects, making it a compelling investment choice.