Williams-Sonoma, Inc. is set to execute a stock split, offering 2 shares for every 1 share held by investors, effective July 9, 2024.

The company’s decision to undergo a stock split aligns it with other prominent companies and aims to make shares more accessible to a broader range of investors.

Despite macroeconomic challenges, Williams-Sonoma continues to show growth, with a diverse portfolio catering to affluent customers and a market capitalization of approximately $17.81 billion.

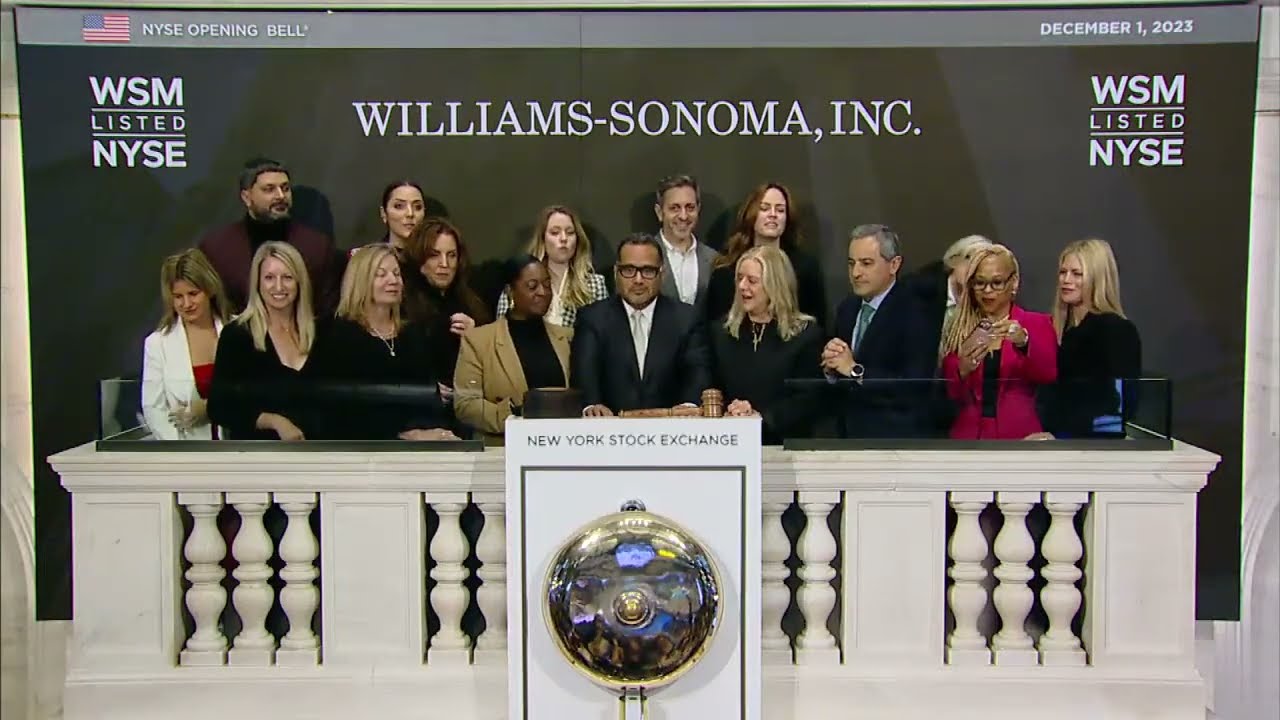

Williams-Sonoma, Inc. (NYSE:WSM), a leading retailer in high-end furniture, kitchenware, and home goods, is set to undergo a significant change in its stock structure. On July 9, 2024, the company will execute a stock split, offering investors 2 shares for every 1 share they currently hold. This move is scheduled to take effect at the beginning of the trading day, marking a pivotal moment for both the company and its shareholders.

Stock splits have been gaining momentum, especially within the tech sector, where a notable number of companies have undergone similar adjustments in recent years. Williams-Sonoma’s decision to implement a stock split places it among other prominent companies, such as Nvidia, Walmart, and Chipotle Mexican Grill, which executed a remarkable split earlier in the year. This trend underscores a growing interest among companies to make their shares more accessible to a wider range of investors.

Despite facing macroeconomic challenges, including higher inflation and a slow real estate market, Williams-Sonoma has continued to demonstrate a growth-oriented approach. The company’s strategy of targeting affluent customers while keeping its products accessible to a broader audience has proven effective. Williams-Sonoma’s portfolio, which includes well-known brands like Pottery Barn and West Elm, caters to a diverse consumer base seeking quality and design.

The announcement of the stock split comes at a time when Williams-Sonoma’s stock price has seen fluctuations. Recently, the stock experienced a decrease of 1.94%, closing at $276.89, down $5.48 from its previous price. Over the past year, the stock has ranged from a low of $120.74 to a high of $348.51, reflecting the company’s resilience and adaptability in a fluctuating market. With a market capitalization of approximately $17.81 billion and a trading volume of 942,800 shares, Williams-Sonoma remains a significant player in the retail sector.

This stock split represents a strategic move by Williams-Sonoma to enhance shareholder value and increase the liquidity of its shares. By making the stock more accessible to a wider range of investors, Williams-Sonoma aims to broaden its investor base and continue its trajectory of growth and expansion in the competitive retail market.