The U.S. government plans to intensify restrictions on China’s access to advanced semiconductor technology. In an upcoming move reported by Reuters, around 140 Chinese entities, including companies and research institutions, will face heightened controls on obtaining critical semiconductor components. These measures reflect the Biden administration’s broader strategy to curb China’s technological advancements in critical sectors, including artificial intelligence and supercomputing.

Key Highlights of the Restriction

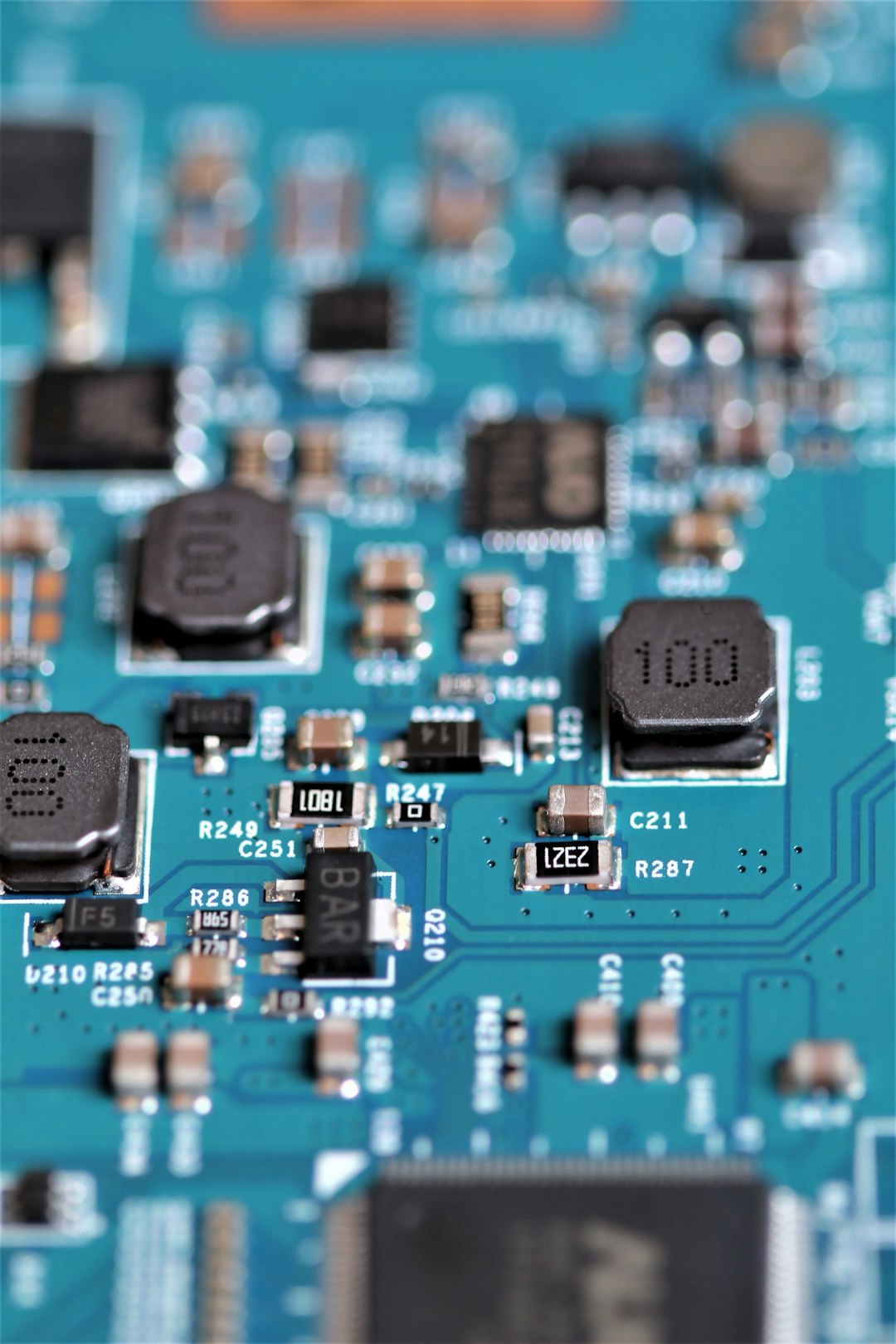

Scope of the Ban: The new rules will specifically target firms involved in advanced chip development, high-performance computing, and military applications. These restrictions aim to prevent Chinese entities from leveraging U.S. technology to enhance their technological and military capabilities.

Impact on China’s Semiconductor Industry: As China has heavily invested in self-reliance for semiconductor manufacturing, these restrictions could pose significant challenges to its progress. Many of the targeted entities rely on U.S.-made equipment and software.

Collaboration with Allies: The U.S. is working with allies, including Japan and the Netherlands, to ensure the export restrictions align globally, limiting China’s ability to source critical chip-making components from alternative suppliers.

Market and Economic Implications

Global Supply Chain Disruption: Stricter export controls could disrupt global semiconductor supply chains, creating ripple effects across the tech industry.

U.S.-China Trade Tensions: These restrictions are expected to escalate trade tensions between the two largest economies, potentially inviting countermeasures from China.

Impact on Semiconductor Stocks: U.S.-based chipmakers like NVIDIA and Intel may face indirect repercussions, as Chinese entities are significant customers for certain products.

What This Means for Investors

Investors should monitor semiconductor stocks and their supply chains for potential volatility. Sectors such as consumer electronics and automotive, which depend on advanced chips, could see price fluctuations due to tighter supply.

To analyze companies exposed to the semiconductor market, explore detailed Balance Sheet Data and Earnings Transcripts. These resources can offer critical insights into a firm’s financial resilience and strategic adaptability.

Future Prospects

The U.S. continues to leverage its technological edge to maintain global dominance and counter China’s ambitions in high-tech innovation. The success of these policies will depend on enforcement effectiveness and the ability of Chinese firms to adapt through domestic innovation.

Stay tuned for further developments as geopolitical and market dynamics evolve.