Who is SHIP?

Seanergy Maritime Holdings Corp. is the only pure-play Capesize shipping company listed in the US capital markets. Seanergy provides marine dry bulk transportation services through a modern fleet of 10 Capesize vessels, with a cargo-carrying capacity of approximately 1,748,581 dwt and an average fleet age of about 9.8 years.

The Company is incorporated in the Marshall Islands with executive offices in Athens, Greece and an office in Hong Kong. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP” and class A warrants under “SHIPW”.

Seanergy Maritime Holdings Corp. (“Seanergy” or the “Company”) (NASDAQ: SHIP) announced today that it will release its financial results for the first quarter ended March 31, 2020 after the market closes in New York on Thursday, June 25, 2020.

The recovery in equities markets and some less dire assessments of the global economy are bringing some buyers back into the beat-up sector.

Capesize rates jumped 14.1%, Panamax rates were up 1.9% and Handysize rates gained 1.5%.

The Baltic capesize index jumped 4% to 3,819, its highest since late September, and has soared more than 150% this week.

A high demand from Chinese steel production and a rise in Brazilian iron ore spot market cargoes will increase the profits for (NASDAQ: SHIP)

Average daily earnings for capesizes, which typically transport cargoes of 170,000 tonnes to 180,000 tonnes, including iron ore and coal, decreased $147 to $25,364.

Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 tonnes to 70,000 tonnes, rose $237 to $10,840.

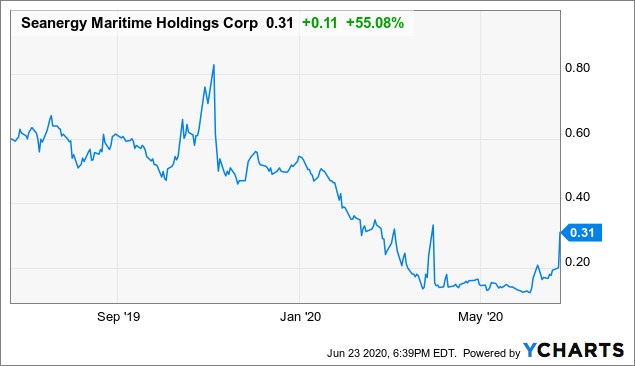

Data by YCharts

[object HTMLElement]

Potentially relevant tickers:

Diana Shipping (NYSE:DSX), DryShips (NASDAQ:DRYS), Eagle Bulk Shipping (NASDAQ:EGLE), Navios Maritime Holdings (NYSE:NM), Navios Maritime Partners (NYSE:NMM), Globus Maritime Limited (NASDAQ:GLBS), Safe Bulkers (NYSE:SB), Scorpio Bulkers (NYSE:SALT), Star Bulk Carriers (NASDAQ:SBLK), Golden Ocean Group Limited (NASDAQ:GOGL), Seanergy Maritime (NASDAQ:SHIP), EuroDry (NASDAQ:EDRY), Genco Shipping & Trading (NYSE:GNK).

Main commodity shipped by $SHIP Iron ore prices have greatly risen and are still rising ✅ China has an insatiable demand and insatiable appetite for iron ore ✅ New deal inked out with the supplier of Tesla ✅ Takeover of two companies using existing stock valued at $1.05 @ 22 million ✅ Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events. Words

such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations

of such words and similar expressions are intended to identify forward-looking statements. These statements

involve known and unknown risks and are based upon a number of assumptions and estimates, which are

inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the

Company. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially include, but are not limited to, the Company’s operating

or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in

the market in which the Company operates; shipping industry trends, including charter rates, vessel values and

factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business

strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks

associated with operations outside the United States; and other factors listed from time to time in the Company’s

filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained

free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly

disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company’s expectations with respect thereto or any

change in events, conditions or circumstances on which any statement is based.

CWEB.com is not registered as an investment adviser with the U.S. Securities and Exchange Commission. Rather, CWEB.com relies upon the “publisher’s exclusion” from the definition of investment adviser as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws.