Elon Musk’s SpaceX is reportedly in talks to deploy Starlink satellite terminals to support the U.S. Federal Aviation Administration’s (FAA) national airspace network, according to Bloomberg. The FAA has already begun testing Starlink in select regions, but the move is raising concerns over potential conflicts of interest.

Key Developments

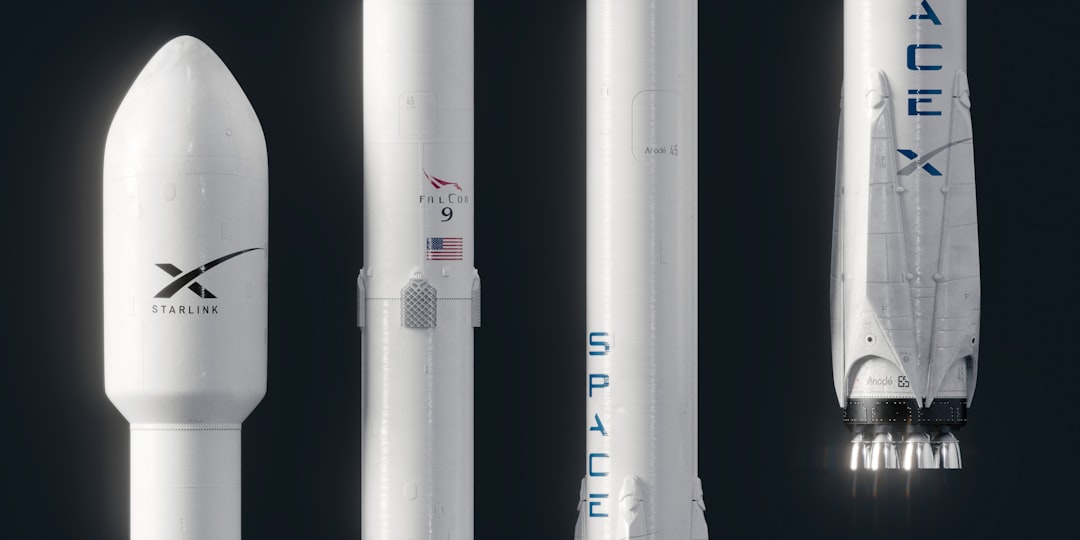

FAA Testing Starlink: The administration is exploring SpaceX’s satellite-based internet to enhance critical airspace communications.

Potential Conflict with Verizon: Verizon (NYSE: VZ) won a $2 billion contract in 2023 to modernize the FAA’s infrastructure, but SpaceX’s involvement could alter existing agreements.

Expanding Starlink’s Reach: SpaceX’s satellite internet service has also partnered with T-Mobile (NASDAQ: TMUS) to offer direct-to-device mobile coverage, bypassing traditional ground-based infrastructure.

Implications for Investors

Competitive Shift in Aviation Communications

If Starlink gains FAA approval, it could challenge traditional telecom providers like Verizon, introducing satellite-driven solutions into government contracts.

Regulatory Scrutiny on Musk’s Influence

The growing influence of Elon Musk’s ventures in U.S. infrastructure projects could invite more government scrutiny, especially in contracts competing with established telecom giants.

SpaceX’s Commercial Growth

With increasing government interest, SpaceX’s Starlink expansion into aerospace and mobile connectivity could boost its long-term revenue prospects.

For investors tracking SpaceX-related market moves, analyzing historical earnings trends of competitors like Verizon and T-Mobile using the Historical Earnings API can provide insights into how the sector may react to SpaceX’s growing footprint.