The S&P 500 experienced a notable surge, closing higher, primarily driven by a significant rally in technology stocks, particularly NVIDIA. This surge reflects the ongoing investor enthusiasm for tech giants, demonstrating resilience in the face of economic uncertainty.

Key Highlights:

Tech Sector Momentum: The tech sector’s resurgence can be attributed to strong earnings reports and optimistic forecasts, particularly from companies like NVIDIA. This shift is indicative of a broader trend where investors are seeking growth opportunities amid market fluctuations.

Investor Sentiment: Optimism surrounding the Federal Reserve’s potential interest rate decisions is contributing to positive investor sentiment. Many are speculating on the possibility of rate cuts, further fueling market enthusiasm.

Market Performance: The S&P 500 index closed up by 1.5%, with tech stocks leading the charge. This rally reflects a robust demand for equities, especially in sectors poised for growth.

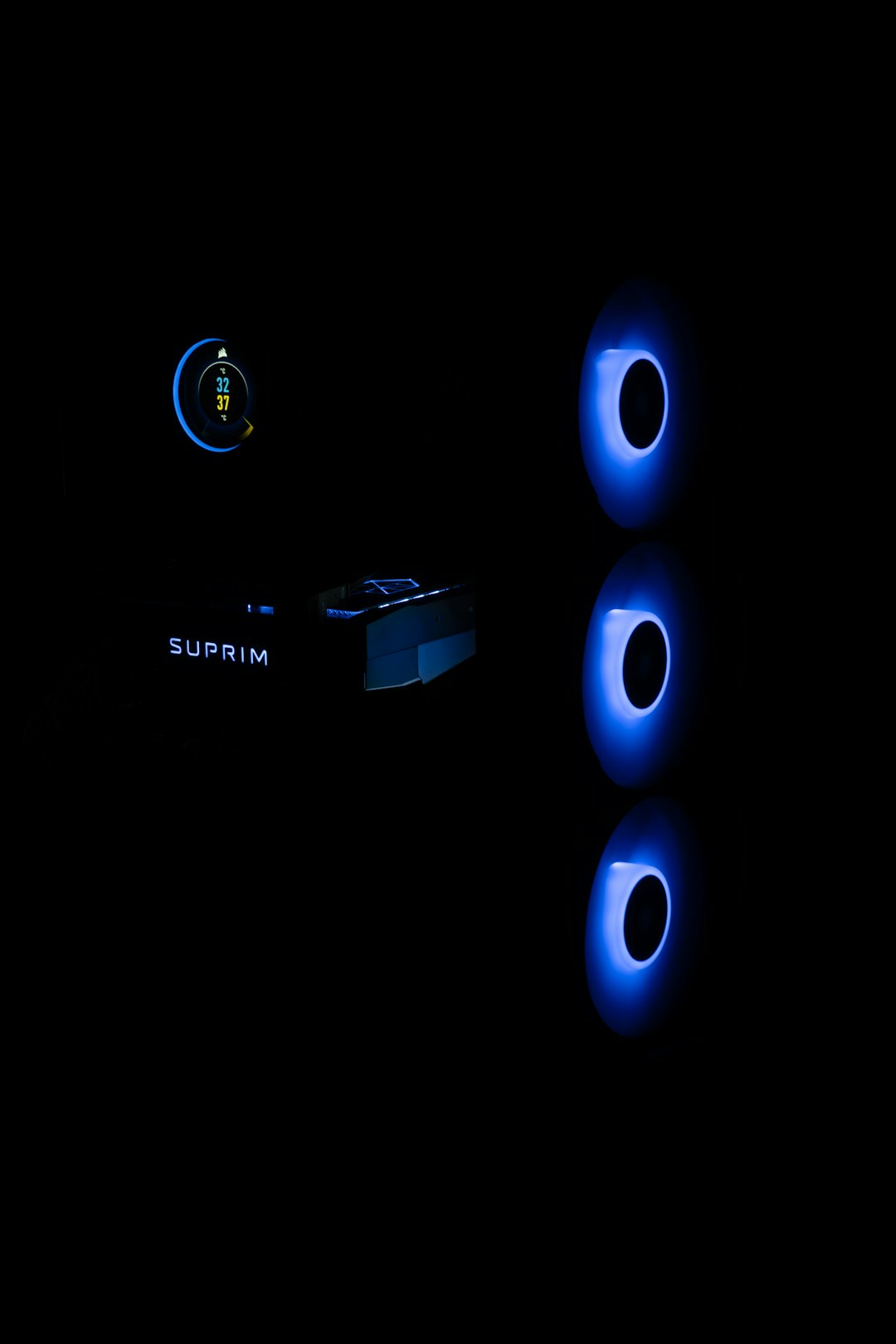

NVIDIA’s Impact: NVIDIA’s performance has been a significant driver of this rally, as it continues to lead in AI technology and gaming. The company’s recent advancements have positioned it as a market leader, attracting substantial investor interest.

Outlook Ahead: Looking forward, analysts predict continued volatility in the market, but the tech sector is expected to remain a focal point for investors seeking growth opportunities.

FMP API Insights:

For detailed insights on market performance and individual stocks, explore the Market Most Active API.

To assess earnings trends and forecasts, consider utilizing the Earnings Calendar API for comprehensive data.