Morgan Stanley reiterates an “Overweight” rating for Robinhood Markets (NASDAQ:HOOD), indicating confidence in its future performance.

The stock price of Robinhood has seen a 3.52% rise, reflecting positive investor sentiment following the company’s potential expansion plans.

Robinhood’s CEO hints at exploring the sports betting market, impacting shares of existing companies in the sector.

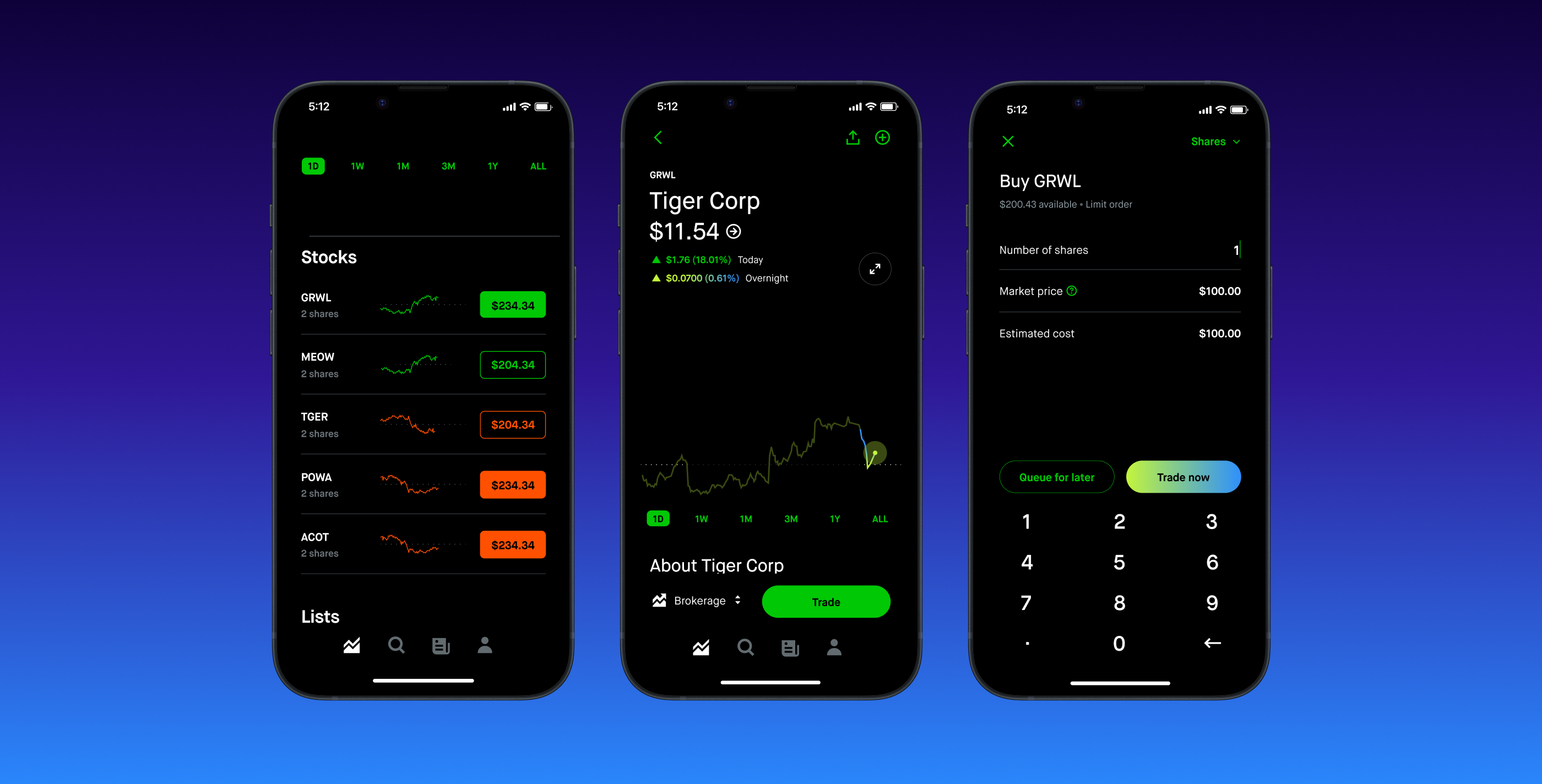

Robinhood Markets (NASDAQ:HOOD) is a financial services company known for pioneering commission-free trading. It has gained popularity among retail investors for its user-friendly platform. The company competes with other brokerage firms like Charles Schwab and E*TRADE. Recently, Morgan Stanley reiterated its “Overweight” rating for Robinhood, suggesting confidence in its future performance.

At the time of Morgan Stanley’s announcement, Robinhood’s stock was priced at $39.54, with a “hold” action associated with the rating. This indicates that investors should maintain their current positions. The stock has since increased to $40, marking a 3.52% rise, or $1.36, in value. This increase reflects positive investor sentiment.

Robinhood’s CEO, Vlad Tenev, has hinted at the company’s potential expansion into the sports betting market. This move could involve event contracts, similar to those launched before the presidential election. Following Tenev’s comments, shares of sports betting companies like Penn Entertainment, Flutter, and DraftKings saw slight declines, indicating market reactions to Robinhood’s potential entry.

The stock’s trading range today has been between $37.78 and $40.57, with the latter being its highest price in the past year. This fluctuation shows the stock’s volatility and investor interest. Robinhood’s market capitalization is approximately $35.36 billion, reflecting its significant presence in the financial services industry.

The trading volume for Robinhood today is 34.76 million shares, indicating active investor participation. This high volume suggests that the market is closely watching Robinhood’s potential moves and future growth prospects.