Pfizer Inc. (NYSE: PFE) offered a cautiously optimistic outlook for 2025, projecting profits in line with Wall Street estimates and steady sales for its COVID-19 products. This announcement comes as the pharmaceutical giant navigates a challenging period marked by declining stock value, shareholder criticism, and a pressing need for pipeline innovation.

Key Highlights

Stock Performance:

Shares rose nearly 3% to $25.98 in premarket trading following the forecast.

Pfizer’s stock is down 12% year-to-date and trades at less than half its pandemic peak value.

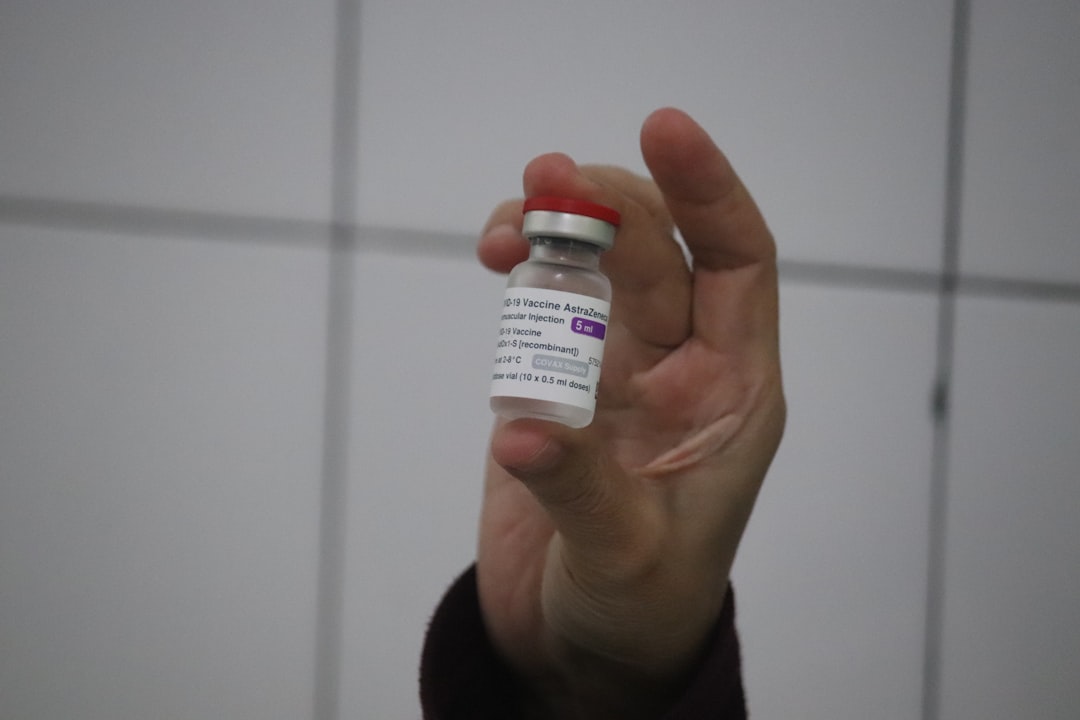

COVID-19 Product Outlook:

The company expects 2025 sales of its COVID-19 vaccine and antiviral treatment to remain consistent with 2024 levels.

COVID-19 products drove immense revenues during the pandemic but now face a plateau in demand.

Pipeline Challenges:

Pfizer must offset potential revenue losses from major drugs nearing patent expiration.

Investor pressure has mounted over the company’s return on acquisitions and the lack of profitable new drugs from its internal R&D efforts.

Shareholder Concerns and Leadership Defense

Criticism from Hedge Fund Starboard

In October, Starboard Value criticized Pfizer’s management for:

Overspending on acquisitions without yielding significant returns.

Failing to develop profitable drugs from either acquisitions or internal research.

CEO Albert Bourla’s Strategy

Bourla defended the company’s turnaround plan, emphasizing:

Cost-cutting measures and shedding non-core businesses to reduce debt.

Investments in a robust pipeline, particularly in oncology.

While these steps aim to strengthen Pfizer’s financial health, analysts and shareholders remain cautious about the timeline for tangible results.

Analyst Outlook

JP Morgan’s Perspective

Analyst Chris Schott sees potential in Pfizer’s oncology pipeline, which could redefine the company’s narrative post-2026.

However, near-term advancements in its pipeline are essential to regain investor confidence.

Broader Market Context

The pharmaceutical sector remains competitive, with companies facing pressure to innovate rapidly. Pfizer’s ability to execute its strategy effectively will determine its positioning in the market over the next few years.

For a closer look at Pfizer’s financial performance and its recovery efforts, the Ratios (TTM) API offers insights into profitability and liquidity metrics.

Future Outlook

Pipeline Innovation:Pfizer’s long-term growth hinges on successful development and commercialization of drugs, particularly in high-value areas like oncology.

Cost Management:The company’s cost-cutting initiatives and focus on debt reduction are critical to maintaining financial stability during this transition.

Market Performance:Investors will closely monitor pipeline advancements and their potential to address revenue gaps left by expiring patents.

Explore Related Data

For detailed insights into Pfizer’s historical financial performance, use the Full Financials API to track trends in revenue, expenses, and net income over time.

Conclusion

Pfizer’s 2025 forecast signals a stabilizing outlook, but the company faces significant challenges in proving its long-term growth potential. With its oncology pipeline offering promise beyond 2026, strategic execution in the near term is vital to rebuilding investor confidence.