Monday.com Ltd. (NASDAQ:MNDY) reported a significant earnings surprise with an EPS of $0.85, surpassing the estimated $0.61.

Despite missing revenue forecasts with $251 million against an expected $261.28 million, the company showcased substantial year-over-year growth.

The company’s stock experienced a downturn despite the positive earnings report, attributed to its high valuation metrics.

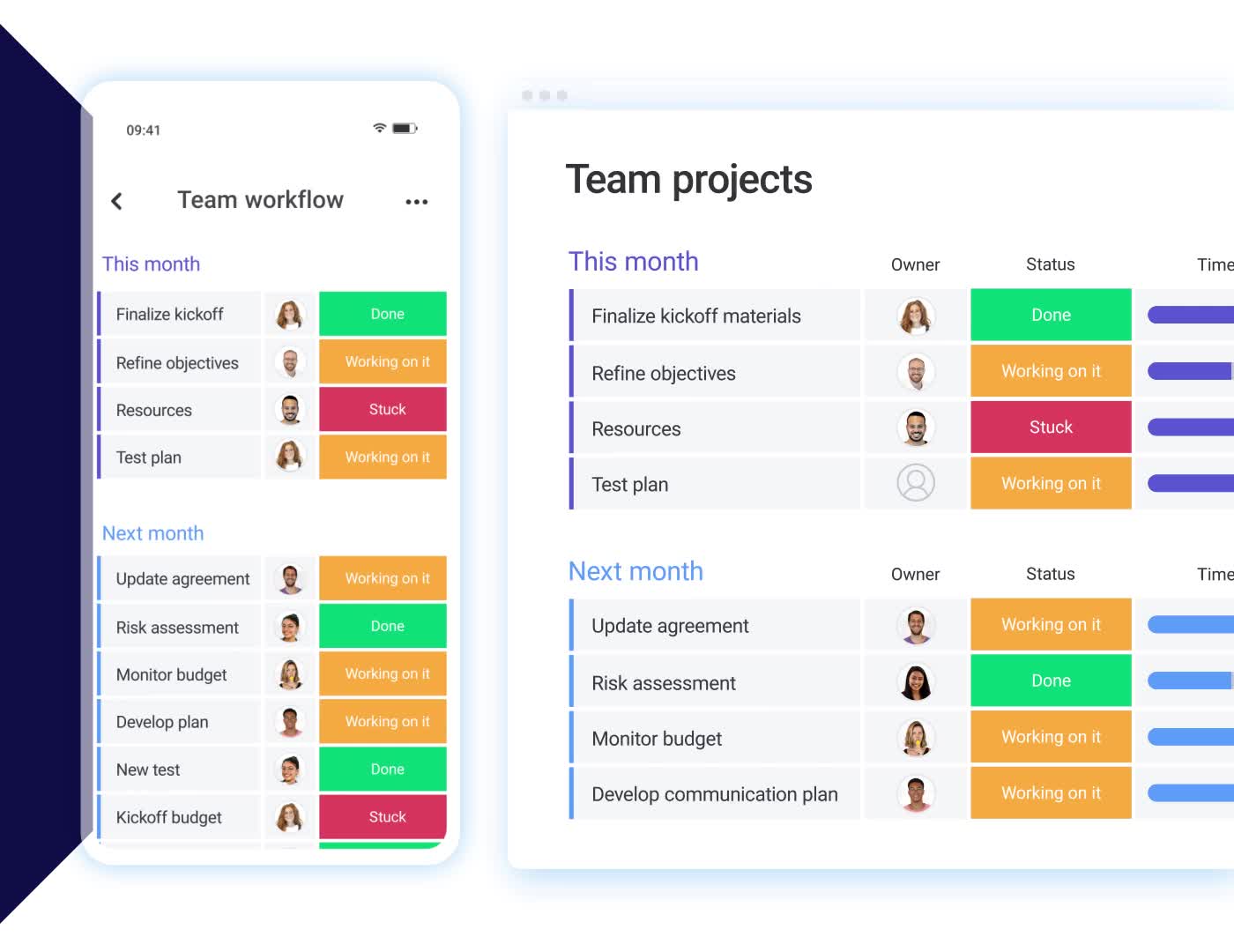

Monday.com Ltd. (NASDAQ:MNDY) is a prominent player in the Internet – Software industry, known for its work operating system that helps teams manage tasks and projects efficiently. The company competes with other software giants in the market, offering innovative solutions to enhance productivity and collaboration.

On November 11, 2024, Monday.com reported its third-quarter earnings, showcasing an impressive earnings per share (EPS) of $0.85. This figure significantly surpassed the estimated $0.61, marking a 39.34% earnings surprise. The company has consistently outperformed consensus EPS estimates over the past four quarters, highlighting its strong financial performance.

Despite the strong EPS, Monday.com reported revenue of $251 million, slightly below the estimated $261.28 million. However, this still represents a substantial increase from the $189.19 million reported in the same period last year. The company has consistently exceeded consensus revenue estimates in the last four quarters, demonstrating robust growth in a competitive industry.

The earnings call on November 11, 2024, featured key company participants and was attended by analysts from major financial institutions, including Goldman Sachs and JPMorgan. The discussion likely covered the company’s financial performance, strategic initiatives, and market outlook, as highlighted by the presence of these prominent analysts.

Despite the positive earnings report, Monday.com experienced a decline in its stock price. The company’s guidance for fourth-quarter revenue was in line with forecasts, which may have contributed to the stock’s downturn, as highlighted by Investor’s Business Daily. The company’s high valuation metrics, such as a P/E ratio of 314.09 and a price-to-sales ratio of 15.38, indicate that investors are paying a premium for its growth potential.