Revenue of $167 million was reported, but overshadowed by a net loss of $1.175 billion.

The gross profit stood at $35 million, indicating some margin over the cost of revenue.

Earnings per share (EPS) was -$3.08, with an EBITDA of -$1.23 billion, highlighting operational losses.

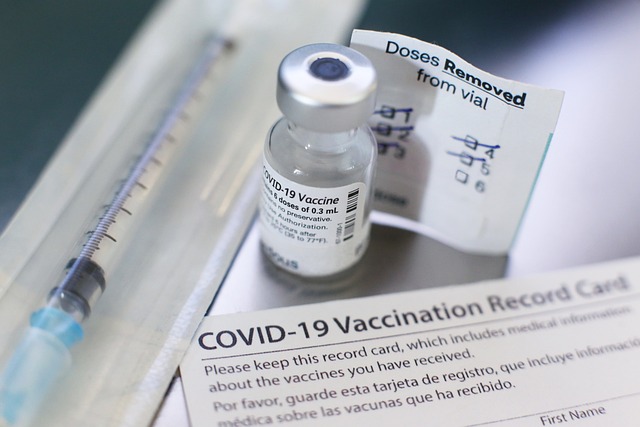

Moderna Inc (NASDAQ:MRNA) recently faced a significant downturn, with its stock price dropping 21% to $94.14. This marked the most substantial decline since November 2021, closely following the announcement of its second-quarter financial results. Moderna, a biotechnology company known for its role in developing one of the first COVID-19 vaccines, operates in a highly competitive and rapidly evolving industry. Its financial performance is closely watched by investors as an indicator of its ability to maintain its position in the market and innovate in the face of challenges.

The financial results for the quarter revealed a revenue of $167 million, which, while substantial, was overshadowed by the company’s net loss of $1.175 billion. This loss is a critical factor contributing to the stock’s sharp decline. The gross profit stood at $35 million, indicating the company’s ability to generate a margin over the cost of revenue, which was reported at $132 million. However, the operating income painted a starkly different picture, with a negative figure of $1.266 billion, further emphasizing the financial challenges faced by Moderna during this period.

The earnings per share (EPS), a key metric used by investors to gauge a company’s profitability on a per-share basis, was -$3.08. This figure is crucial as it directly impacts investor sentiment and can influence the stock’s market performance. Additionally, the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of -$1.23 billion further highlights the operational losses incurred by the company, beyond the simple net income figures.

Income before tax also showed a significant loss of $1.165 billion, with an income tax expense of $10 million. These figures collectively provide a comprehensive view of the financial difficulties faced by Moderna in the quarter, contributing to the sharp decline in its stock price. The financial metrics indicate not only the immediate losses but also suggest challenges in profitability and operational efficiency that the company must address.

In summary, Moderna’s second-quarter financial results reveal a complex picture of significant revenue generation overshadowed by substantial losses across several key financial metrics. The sharp decline in the stock price reflects investor reactions to these challenges, highlighting the importance of closely monitoring financial performance and market conditions in the biotechnology sector.