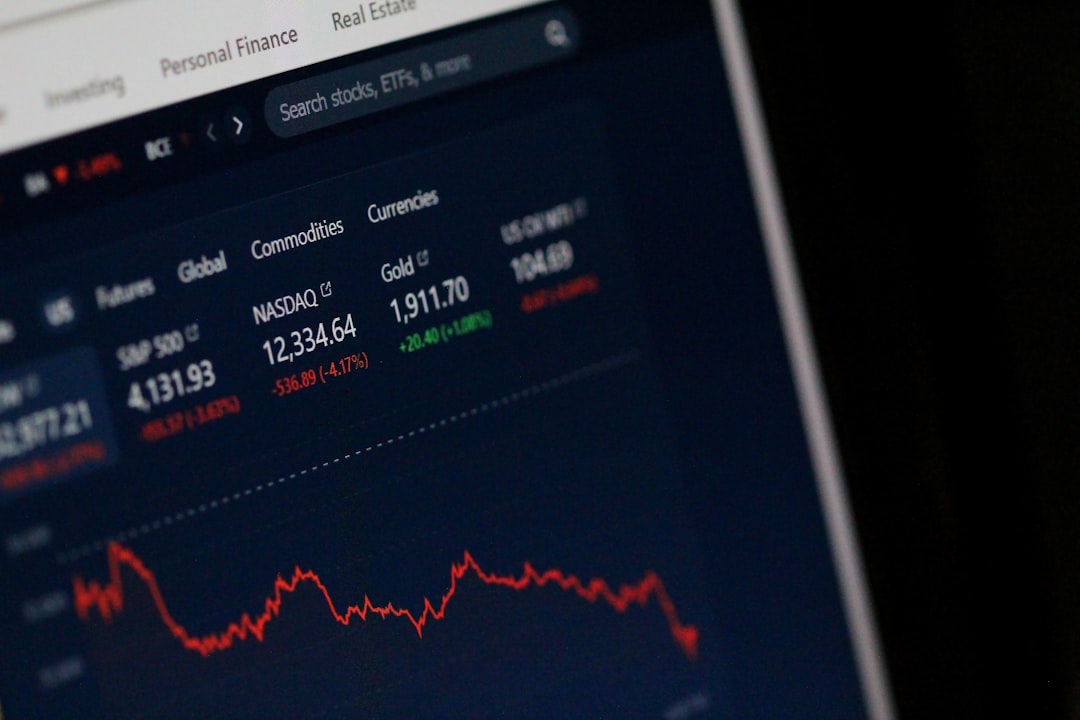

Stock markets and the dollar remained cautiously higher on Wednesday as investors assessed vague but optimistic headlines from U.S.-China trade talks.

U.S.-China Reach Broad Trade Framework

Negotiators from both countries said they had agreed on a framework deal, with U.S. Commerce Secretary Howard Lutnick confirming:

Restrictions on rare earth exports from China are “resolved.”

The framework adds “meat on the bones” of earlier Geneva agreements.

But final approval still rests with Trump and Xi Jinping.

Despite the headlines, details remain scant, and markets are aware this could be more symbolic than structural.

? “A comprehensive deal usually takes years. I’m skeptical this will change much in the near term.”— Carol Kong, CBA Currency Strategist

Tariff Legal Ruling Raises Questions

Separately, a federal appeals court allowed Trump’s sweeping tariffs to remain active—despite an earlier trade court ruling that tried to block them.

This legal green light maintains one of Trump’s most aggressive economic policies.

Small businesses had sued, citing damage from what they called an unjustified emergency declaration.

Inflation Data: The Next Big Test

Markets are now focused on incoming U.S. CPI data, expected to show:

Whether tariffs are pushing consumer prices higher.

Early signs of import-led inflation from trade disruptions.

Implications for Federal Reserve policy, especially after Friday’s strong jobs report.

Stay ahead of macroeconomic shifts with the Economic Calendar API, which offers real-time access to inflation reports, interest rate decisions, and other high-impact data.

Treasury Auction, Dollar Reaction

The U.S. dollar held firm, supported by the trade optimism and inflation hedging.

Bond yields were flat as investors waited for demand signals from an upcoming Treasury auction.

What It Means for Markets

Investors are cautiously optimistic but want:

Concrete implementation steps from the trade framework.

Inflation data to confirm or challenge tariff pass-through risks.

A clearer Fed path before rotating into more risk-heavy positions.

Until then, most asset classes may stay in a holding pattern.