Introduction

Shares of Japanese entertainment giant Kadokawa Corporation skyrocketed by 16% following reports of acquisition talks with Sony Group. This potential deal has ignited excitement in the market, reflecting the growing consolidation trend in the entertainment and gaming sectors.

Kadokawa’s Strategic Significance

1. A Leader in Multimedia

Kadokawa is a powerhouse in publishing, anime, and gaming, making it a highly desirable acquisition target. Its assets include popular anime titles, a robust gaming portfolio, and a significant stake in FromSoftware, the creator of Elden Ring.

2. Sony’s Ambitions

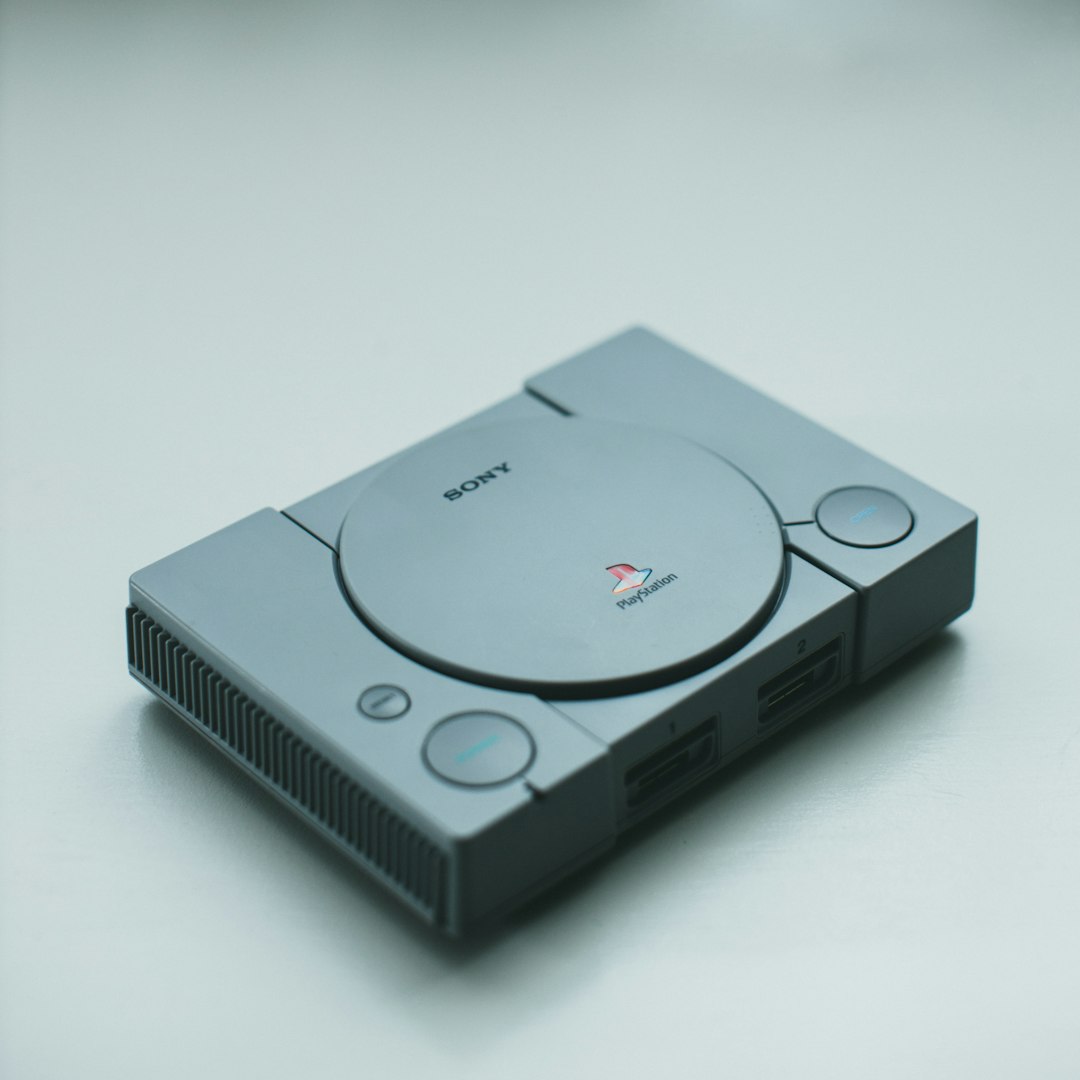

For Sony, acquiring Kadokawa could bolster its PlayStation ecosystem and strengthen its position as a leader in the gaming and entertainment sectors.

Key Drivers Behind the Surge

1. Market Optimism

The potential acquisition aligns with Sony’s strategy to integrate complementary assets, driving Kadokawa’s stock to its highest levels in months.

2. Gaming Sector Consolidation

The gaming industry has seen increased mergers and acquisitions as companies seek to diversify their portfolios and compete in a highly dynamic market.

Financial Implications

Kadokawa’s Valuation Metrics

Kadokawa’s valuation is a key focal point for investors. Analyzing its performance through Owner Earnings API provides a clear picture of cash flow generation and long-term profitability.

Sector-Wide Impact

Sony’s move could trigger a ripple effect, prompting competitors to explore similar acquisitions to stay competitive. Industry P/E Ratio API offers insights into valuation trends across the industry, enabling investors to assess sector dynamics.

Opportunities and Challenges

Opportunities:

Content Synergy: Kadokawa’s anime and gaming assets complement Sony’s existing entertainment lineup, creating cross-platform growth opportunities.

Global Expansion: The acquisition could expand Sony’s footprint in global markets, leveraging Kadokawa’s strong presence in Asia.

Challenges:

Regulatory Scrutiny: High-profile acquisitions often face regulatory hurdles, particularly in Japan’s tightly monitored corporate landscape.

Integration Risks: Merging Kadokawa’s operations with Sony’s existing business may present logistical challenges.

Strategic Insights for Investors

Investors should monitor Kadokawa’s performance closely, particularly in light of acquisition-related volatility. Examining Kadokawa’s owner earnings provides a lens into its long-term value, while sector-wide P/E comparisons help contextualize the deal’s broader implications.

Conclusion

Kadokawa’s potential acquisition by Sony is a game-changing development that underscores the competitive intensity in the entertainment sector. With its stock surging on the news, the deal represents a pivotal moment for both companies and a significant opportunity for investors seeking exposure to the evolving multimedia landscape.