Japan Stocks Edge Lower as Nikkei 225 Closes Down 0.25%

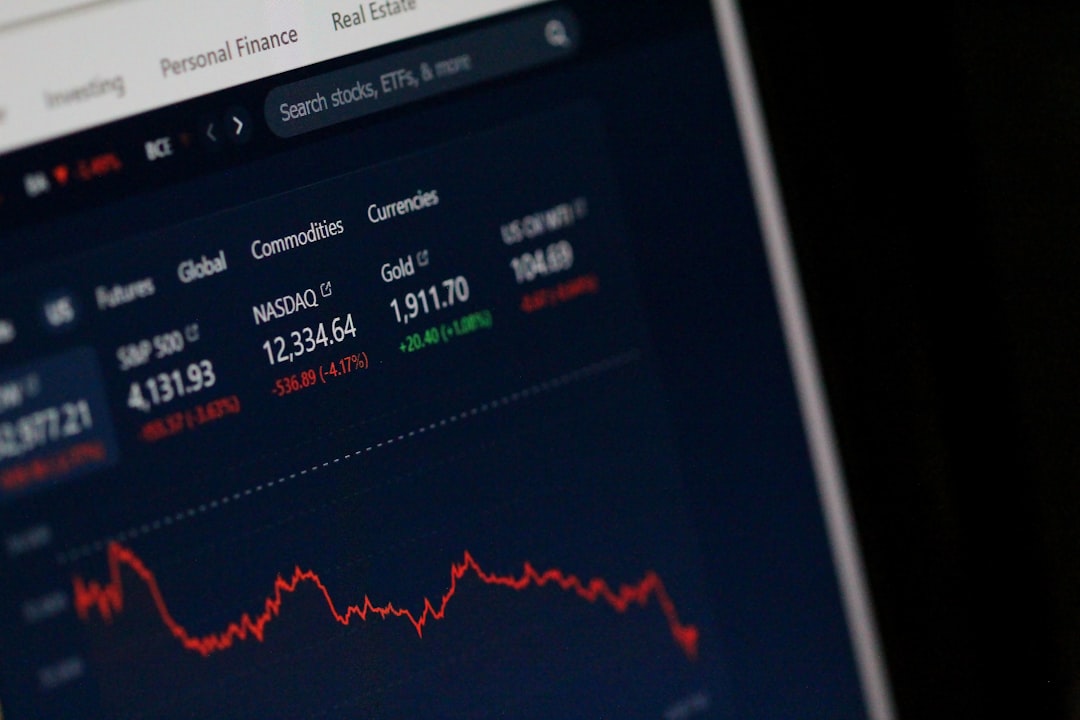

The Japanese stock market saw a dip as the Nikkei 225 index closed 0.25% lower on the day. Despite strong corporate earnings in several sectors, the market was weighed down by concerns over the global economic outlook and an upcoming interest rate decision by the U.S. Federal Reserve.

Key Drivers of the Decline

Tech Sector Weakness: Tech companies in Japan, particularly semiconductor and electronics manufacturers, saw a decline amid growing fears of a potential global economic slowdown. This sector has been particularly sensitive to shifts in demand and macroeconomic conditions.

Global Interest Rate Uncertainty: Investors are closely watching the Federal Reserve’s upcoming rate decisions, as changes in U.S. monetary policy have significant ripple effects on global markets, including Japan. With ongoing concerns about inflation and recession fears, market sentiment remained cautious.

Stronger Yen: A stronger yen against the U.S. dollar also impacted exporter stocks. Companies reliant on overseas sales saw their earnings potential diminish as a result of unfavorable exchange rates.

Market Sector Performance

Automobiles: Car manufacturers were among the few sectors to perform relatively well, with positive earnings outlooks and recovery in global supply chains contributing to their stability.

Energy: Energy stocks also saw some gains amid rising oil prices, although they couldn’t fully offset the losses in other sectors.

Historical Patterns

Historically, Japanese stocks, especially those in export-heavy industries, tend to react negatively to a stronger yen and uncertainties surrounding U.S. interest rate decisions. As seen in the past, periods of yen appreciation often coincide with a sell-off in major indexes like the Nikkei 225.

For detailed insights into Japanese companies’ financial metrics, including their performance during periods of currency fluctuations, you can check Full Financials API and the Key Metrics API.

Outlook

Moving forward, investor sentiment will likely hinge on key macroeconomic data from the U.S. and other global markets. Analysts expect continued volatility in the Japanese market as companies adapt to external economic pressures.

For a broader global economic context, check Reuters for the latest updates on the intersection of U.S. monetary policy and its global impacts.