GrubHub Inc. NYSE: GRUB Grubhub rises up 11% on reports of potential buyers from two European peers Just Eat and Delivery Hero. There were rumors of UBER buying out GrubHub, but anti-trust concerns had become a concern.

Offer are coming in as an all-stock transaction and a combination of stock and cash. Grubhub Q1 Earnings Beat and revenues rose year over year. With restaurants slowly beginning to open due to COVID-19 stay at home orders, many are still unemployed, and this may affect the online food delivery service.

Long term debt as of Mar 31, 2020 was $668.2 million compared with $493 million as of Dec 31, 2019. The company has repaid back a loan for $175 million from its $225 million revolving credit.

“Matt Maloney is founder and CEO of Grubhub a leading online and mobile food-ordering and delivery marketplace with the largest and most comprehensive network of restaurant partners. Under Matt’s leadership, Grubhub has grown its active diner network to more than 22 million users who can order from more than 300,000 takeout restaurants in over 3,200 cities. He led the company through five rounds of investment funding, a 2013 merger with Seamless, and a 2014 initial public offering.” Source: https://about.grubhub.com/about-us/executive-team/default.aspx

Top Institutional Holders

Holder Shares Date Reported % Out Value

Caledonia (Private) Investments Pty Ltd 15,008,694 Mar 30, 2020 16.33% 611,304,106

Baillie Gifford and Company 9,763,814 Mar 30, 2020 10.62% 397,680,144

Blackrock Inc. 8,725,287 Mar 30, 2020 9.49% 355,380,939

Vanguard Group, Inc. (The) 8,499,532 Mar 30, 2020 9.25% 346,185,938

UBS Group AG 4,343,115 Mar 30, 2020 4.73% 176,895,073

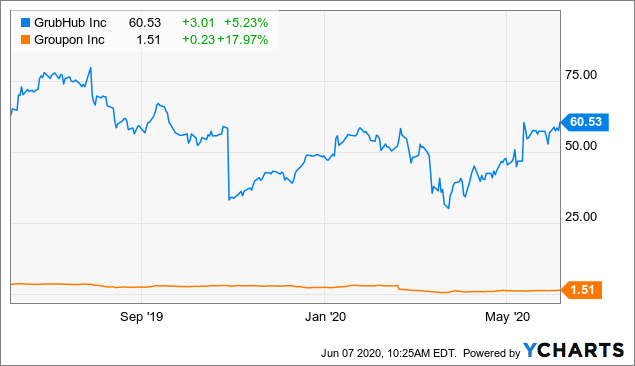

Data by YCharts

Data by YCharts

Top Mutual Fund Holders

Holder Shares Date Reported % Out Value

iShares Core S&P Midcap ETF 2,659,124 Jan 30, 2020 2.89% 143,991,564

Vanguard Total Stock Market Index Fund 2,569,600 Dec 30, 2019 2.80% 124,985,344

First Trust Dow Jones Internet Index (SM) Fund 2,415,338 Dec 30, 2019 2.63% 117,482,040

Vanguard Small-Cap Index Fund 2,309,571 Dec 30, 2019 2.51% 112,337,533

College Retirement Equities Fund-Growth Account 1,844,169 Dec 30, 2019 2.01% 89,700,380

Vanguard U.S. Growth Fund 1,734,410 Feb 28, 2020 1.89% 83,442,465

Know we want to pick up on some very interesting fact about a possible partnership or some kind of deal between this two giants. According to an article from Cornell College of Business published on May 23rd by Bryan Burroughs he saw a very clear link between Groupon and Grubhub.

“ We also saw potential for strategic partnerships between Grubhub’s and Groupon’s restaurant relationships. For example, as another group pointed out, Grubhub could sell Groupon discounts to consumers as they were ordering food. This would generate more revenue for the combined company and save customers money–always a win-win! “

Read Full Article https://business.cornell.edu/hub/2019/05/23/grubhub-groupon-merge/

Grubhub is currently trading around $60 and we can see a huge spike to over $100. Groupon at the same time is the cheapest e commerce platform that has online and offline presence and is currently trading around $1.50 with an upside of $60. Groupon has a very solid portfolio of cash close to $900 Million and sales reaching close to $3 Billion early. It is hard to imagine that stocks who are trading above $20 are not even close to the balance sheet of Groupon.

CWEB.com is not registered as an investment adviser with the U.S. Securities and Exchange Commission. Rather, CWEB.com relies upon the “publisher’s exclusion” from the definition of investment adviser as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws.