Dunkin’ Brands Group DNKN- stock was rising on Monday. The doughnut chain announced it is hiring 25,000 workers and KeyBanc Capital Markets upgraded the stock, with a $78 price target.

As the economy slowly recovers, people will still need to be cautious about their money. Groupon will revolutionize the Coupon industry. Coupons work much the same way, except the payoff is in smaller increments. Companies allocate so many dollars a year to attract customers to their products, businesses or services.

What are the benefits of using coupons?

For Consumers

- Buy More Items. Wise consumers can save a good amount of money when using coupons to buy their necessities

- Avail dream products

- Save money

- Suggest when to buy

- Retains old and attract new consumers

- Helps off-load older products

- Reduce advertising expenses

- Help identify potential customers.

Using coupons brings joy. This isn’t our own hyperbole talking, but rather, science: A Claremont University study discovered that receiving and using coupons decreased stress and increased a person’s oxytocin levels–which are associated with happiness–by 38 percent (which is a larger increase than kissing!).

Yesterday Dunkin‘ franchise announced that they will be adding 25,000 jobs as restaurants start to re-open in the U.S. The breakfast and coffee chain announced Monday that its franchisees are looking to fill a range of positions, including management roles. Dunkin‘ launched an ad campaign on Monday to support recruiting efforts.

Dunkin’ Donuts plans to hire 25,000 employees as states reopen

People return to work they will be visiting Duncan donuts more often. More than half of Dunkin Donut stores are located in the Northeast, a heavily Den market. While these areas of the country have been extremely hard hit with the Coronavirus, we believe there will be a big rebound once the economy’s strikes back up again. Dunkin Donuts has proven itself against other fast-food change that offer breakfast such as McDonald’s (MCD) .

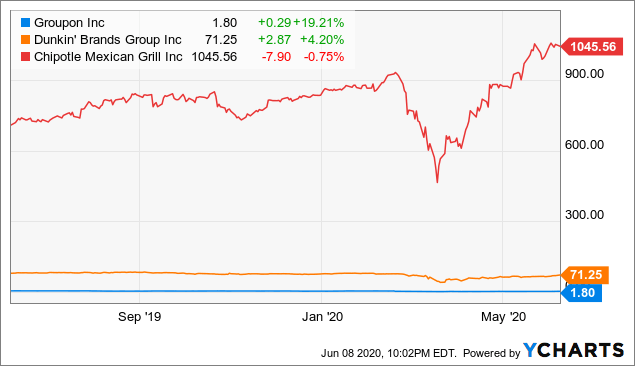

As the economy slowly recovers, people will still need to be cautious about their money. People will benefit more from getting a daily deal on Groupon for $6 for a $10 Dunkin’ Card for Donuts, Coffee, and Breakfast Fare at Dunkin’ Donuts- one of the offers they had on Groupon, Inc. (GRPN) Nasdaq. We see both stocks rising all the way the end of the year and beyond: Strong Buy

David Hoffmann Named Dunkin’ Brands CEO; Nigel Travis Appointed Executive Chairman. Mr. Hoffmann joined Dunkin’ Brands as President of Dunkin’ Donuts U.S. in October 2016. Since that time, he has overseen the implementation of a multi-year Blueprint for Growth designed to transform Dunkin’ Donuts into the leading beverage-led, on-the-go brand. Source: David Hoffmann Named Dunkin’ Brands CEO; Nigel Travis Appointed Executive Chairman

Top 6 Institutional Holders

Holder Shares Date Reported % Out Value

Blackrock Inc. 8,638,600 Mar 30, 2020 10.52% 458,709,660

Vanguard Group, Inc. (THE) 7,667,127 Mar 30, 2020 9.34% 407,124,443

Price (T.Rowe) Associates Inc 7,408,665 Mar 30, 2020 9.02% 393,400,111

Janus Henderson Group PLC 5,927,618 Mar 30, 2020 7.22% 314,756,515

Jackson Square Partners, LLC 2,676,585 Mar 30, 2020 3.26% 142,126,663

State Street Corporation 1,974,394 Mar 30, 2020 2.40% 104,840,321

[object HTMLElement]

Top 5 Mutual Fund Holders

Holder Shares Date Reported % Out Value

Janus Henderson Enterprise Fund 3,419,609 Dec 30, 2019 4.16% 258,317,263

Price (T.Rowe) Mid Cap Growth Fund 2,500,000 Dec 30, 2019 3.04% 188,850,000

iShares Core S&P Midcap ETF 2,414,579 Jan 30, 2020 2.94% 188,554,474

Vanguard Total Stock Market Index Fund 2,325,778 Dec 30, 2019 2.83% 175,689,270

Vanguard Small-Cap Index Fund 2,066,865 Dec 30, 2019 2.52% 156,130,982

Groupon ( NASDAQ:$GRPN) has a huge success with merchants that are able to offer exclusive codes to each customer. Different promotions tend to perform better for certain sites, so Groupon carefully evaluates which deals will resonate the best on each of our platforms in order to achieve the highest rate of success.

Our Top Stock are Walmart which is grossly undervalued and should be trading above $300 and Groupon (NASDAQ:GRPN) with a potential upside $50 by end of the year with strong holiday sales and retail spending. Another company we like is Google Alphabet ( NASDAQ:GOOGL ) with an upside of $2000 and Apple ( NASDQ:AAPL ) with upside of $1000.