As the global economy navigates through a period of uncertainty, the focus is now on the Federal Reserve’s upcoming projections, which could signal more significant rate cuts than previously anticipated. According to a recent analysis by Citi, these projections could point to a more accommodative stance by the Fed in its monetary policy approach.

The Federal Reserve’s Shifting Stance on Interest Rates

The Federal Reserve, commonly referred to as the Fed, plays a critical role in shaping the economic landscape through its control of interest rates. In recent months, the Fed has faced a delicate balancing act between curbing inflation and supporting economic growth. However, new forecasts suggest that the Fed may be more inclined towards cutting rates deeper than initially expected to cushion the economy.

Citi’s Insights: Economists at Citi have indicated that the Fed’s upcoming projections could reflect a more aggressive approach to rate cuts, potentially signaling a shift in its economic outlook. The deeper cuts might be a response to signs of a slowdown in economic growth and ongoing global uncertainties.

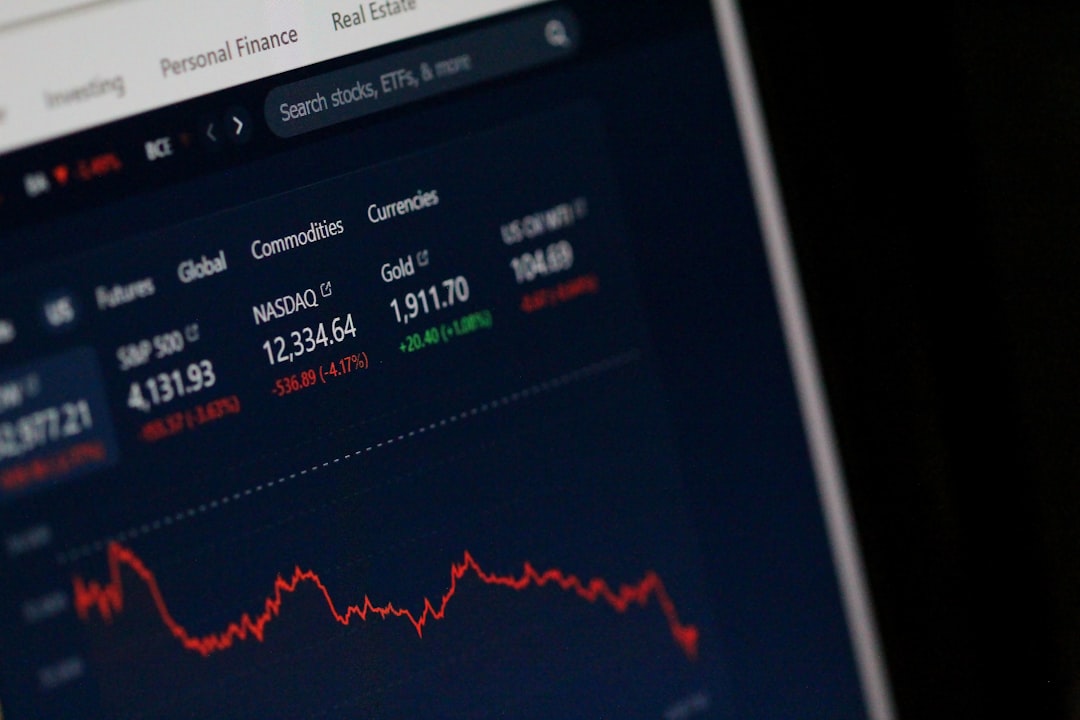

Investors and market analysts closely monitor the Fed’s projections to understand future policy directions. The expected rate cuts could have broad implications for financial markets, influencing everything from stock prices to bond yields.

For investors looking to stay informed about economic developments and forecasts, FMP’s Economics Calendar API provides real-time data on key economic events, including Fed meetings and projections.

Implications for Financial Markets

A more dovish Fed stance could provide a boost to equity markets, especially growth-oriented sectors like technology, which tend to benefit from lower interest rates. At the same time, sectors such as banking and finance, which typically thrive in a higher interest rate environment, might face some pressure.

Impact on Stocks: Tech stocks, which have already been driving the market’s gains, could see further upward momentum if the Fed signals a more accommodative monetary policy.

Impact on Bonds: A deeper rate cut could push bond yields lower, making fixed-income securities less attractive to investors. This scenario could lead to a search for higher yields in riskier assets, driving capital flows into equities and other growth investments.

The evolving economic landscape requires investors to stay agile and informed. FMP’s Advanced DCF API helps investors evaluate the intrinsic value of stocks in light of changing interest rates and economic conditions.

Global Economic Uncertainty and the Fed’s Projections

The Fed’s policy decisions do not exist in a vacuum. Global economic uncertainties, ranging from geopolitical tensions to fluctuating commodity prices, also influence its actions. A more dovish projection from the Fed could be a strategic move to provide a safety net for the U.S. economy amid these uncertainties.

Citi’s Projection of Deeper Cuts: Citi analysts predict that the Fed could revise its economic outlook, emphasizing downside risks and paving the way for more significant cuts. This approach would be designed to mitigate potential downturns and support continued economic expansion.

Market Reaction: Investors are likely to react positively to such news, with increased buying in growth sectors and a potential rally in broader markets. However, the long-term impact will depend on how these rate cuts align with broader economic conditions.

What This Means for Investors

For investors, understanding the Fed’s policy direction is crucial for navigating financial markets. The potential for deeper rate cuts could present both opportunities and challenges across different asset classes. While growth stocks may benefit from lower rates, income-focused investors might need to explore alternative investment strategies to achieve desired returns.

To effectively manage risk and capitalize on potential opportunities, investors can leverage tools like FMP’s Full Financial as Reported API, which provides comprehensive financial data to help assess the fundamentals of various stocks in a changing interest rate environment.

Conclusion

The upcoming Fed projections are likely to be a pivotal moment for financial markets, as investors seek clues about the central bank’s future policy moves. With Citi’s expectations of deeper cuts, the focus will be on how markets interpret these signals and adjust accordingly. For investors, staying informed and prepared is key to navigating the evolving economic landscape.

By utilizing Financial Modeling Prep’s range of APIs, investors can access real-time economic data, evaluate stock valuations, and stay ahead of market trends. With the right tools, navigating potential rate cuts and their impact becomes a more manageable endeavor.

Fed’s Upcoming Projections May Indicate Deeper Rate Cuts Than Expected: Insights from Citi

As the global economy navigates through a period of uncertainty, the focus is now on the Federal Reserve’s upcoming projections, which could signal more significant rate cuts than previously anticipated. According to a recent analysis by Citi, these projections could point to a more accommodative stance by the Fed in its monetary policy approach.

The Federal Reserve’s Shifting Stance on Interest Rates

The Federal Reserve, commonly referred to as the Fed, plays a critical role in shaping the economic landscape through its control of interest rates. In recent months, the Fed has faced a delicate balancing act between curbing inflation and supporting economic growth. However, new forecasts suggest that the Fed may be more inclined towards cutting rates deeper than initially expected to cushion the economy.

Citi’s Insights: Economists at Citi have indicated that the Fed’s upcoming projections could reflect a more aggressive approach to rate cuts, potentially signaling a shift in its economic outlook. The deeper cuts might be a response to signs of a slowdown in economic growth and ongoing global uncertainties.

Investors and market analysts closely monitor the Fed’s projections to understand future policy directions. The expected rate cuts could have broad implications for financial markets, influencing everything from stock prices to bond yields.

For investors looking to stay informed about economic developments and forecasts, FMP’s Economics Calendar API provides real-time data on key economic events, including Fed meetings and projections.

Implications for Financial Markets

A more dovish Fed stance could provide a boost to equity markets, especially growth-oriented sectors like technology, which tend to benefit from lower interest rates. At the same time, sectors such as banking and finance, which typically thrive in a higher interest rate environment, might face some pressure.

Impact on Stocks: Tech stocks, which have already been driving the market’s gains, could see further upward momentum if the Fed signals a more accommodative monetary policy.

Impact on Bonds: A deeper rate cut could push bond yields lower, making fixed-income securities less attractive to investors. This scenario could lead to a search for higher yields in riskier assets, driving capital flows into equities and other growth investments.

The evolving economic landscape requires investors to stay agile and informed. FMP’s Advanced DCF API helps investors evaluate the intrinsic value of stocks in light of changing interest rates and economic conditions.

Global Economic Uncertainty and the Fed’s Projections

The Fed’s policy decisions do not exist in a vacuum. Global economic uncertainties, ranging from geopolitical tensions to fluctuating commodity prices, also influence its actions. A more dovish projection from the Fed could be a strategic move to provide a safety net for the U.S. economy amid these uncertainties.

Citi’s Projection of Deeper Cuts: Citi analysts predict that the Fed could revise its economic outlook, emphasizing downside risks and paving the way for more significant cuts. This approach would be designed to mitigate potential downturns and support continued economic expansion.

Market Reaction: Investors are likely to react positively to such news, with increased buying in growth sectors and a potential rally in broader markets. However, the long-term impact will depend on how these rate cuts align with broader economic conditions.

What This Means for Investors

For investors, understanding the Fed’s policy direction is crucial for navigating financial markets. The potential for deeper rate cuts could present both opportunities and challenges across different asset classes. While growth stocks may benefit from lower rates, income-focused investors might need to explore alternative investment strategies to achieve desired returns.

To effectively manage risk and capitalize on potential opportunities, investors can leverage tools like FMP’s Full Financial as Reported API, which provides comprehensive financial data to help assess the fundamentals of various stocks in a changing interest rate environment.

Conclusion

The upcoming Fed projections are likely to be a pivotal moment for financial markets, as investors seek clues about the central bank’s future policy moves. With Citi’s expectations of deeper cuts, the focus will be on how markets interpret these signals and adjust accordingly. For investors, staying informed and prepared is key to navigating the evolving economic landscape.

By utilizing Financial Modeling Prep’s range of APIs, investors can access real-time economic data, evaluate stock valuations, and stay ahead of market trends. With the right tools, navigating potential rate cuts and their impact becomes a more manageable endeavor.