As Donald Trump prepares to assume office as the 47th President of the United States on January 20, Evercore ISI strategists have outlined several potential surprises for the financial markets in 2025. From unexpected stock market returns to shifts in bond yields, these forecasts highlight possible scenarios investors should watch closely.

1. A “Three-Peat” for the S&P 500

Evercore suggests the S&P 500 could post a third consecutive year of 20%+ returns, defying expectations of elevated valuations and rising yields. Key drivers include:

A surge in AI adoption boosting corporate growth.

Historical data indicating that “high valuation alone doesn’t end bull markets.”

This optimistic outlook suggests that broader market participation, beyond the dominant tech-centric “Magnificent 7,” could fuel gains.

2. Stable S&P 500 EPS Estimates

Contrary to widespread expectations of declining earnings in 2025, Evercore forecasts stability in the S&P 500’s EPS estimate of $274, driven by:

Strong profit margins that remain resilient.

A moderating U.S. Dollar, boosting overseas growth.

If these factors materialize, the “other 490” stocks in the S&P 500 are expected to outperform the Magnificent 7 group for the first time since the launch of generative AI technologies like ChatGPT.

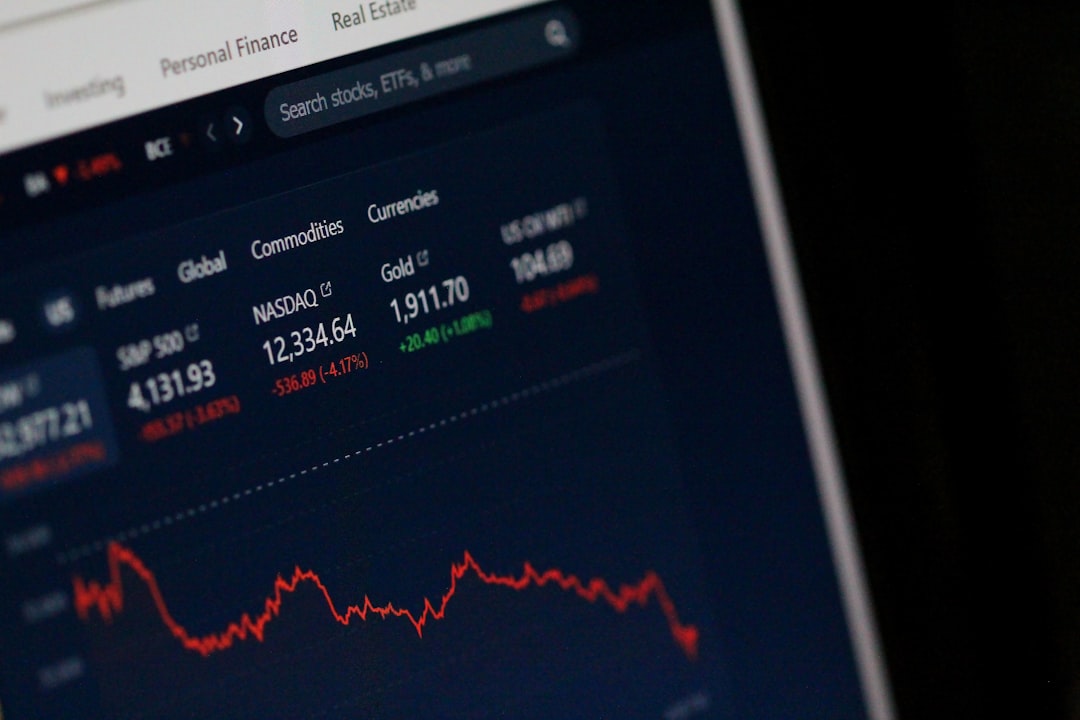

3. Bond Yields Breaking the “4s”

The 10-year U.S. Treasury yield, widely expected to hover between 4% and 5%, could break this range due to:

Debt ceiling crises or other fiscal challenges.

Unanticipated shifts in economic growth or inflation trends.

These scenarios could lead to either a sharp increase or a surprising drop in yields, creating volatility in fixed-income markets.

Investing Insights

To stay ahead of these trends, investors can leverage tools to analyze historical market behavior and economic indicators. For example:

Use the Sector Historical API for insights into sector performance over previous economic cycles.

Analyze earnings trends and projections through the Earnings Historical API to gauge the market’s trajectory.

Conclusion

Evercore ISI’s outlook for 2025 offers a contrarian perspective on market expectations, highlighting opportunities in equity markets and potential volatility in bonds. As the global economy adjusts to policy changes under Trump’s administration, investors should remain flexible and well-informed to navigate emerging trends effectively.