In a decisive move underscoring a robust foreign economic policy, the administration of President Donald J. Trump has initiated high-level negotiations to establish a substantial $20 billion currency swap line for the Argentine Central Bank.

This strategic maneuver, reported by CWEB Business News, signals a powerful U.S. commitment to bolstering a key ally in Latin America, President Javier Milei, and fostering economic stability in the region.

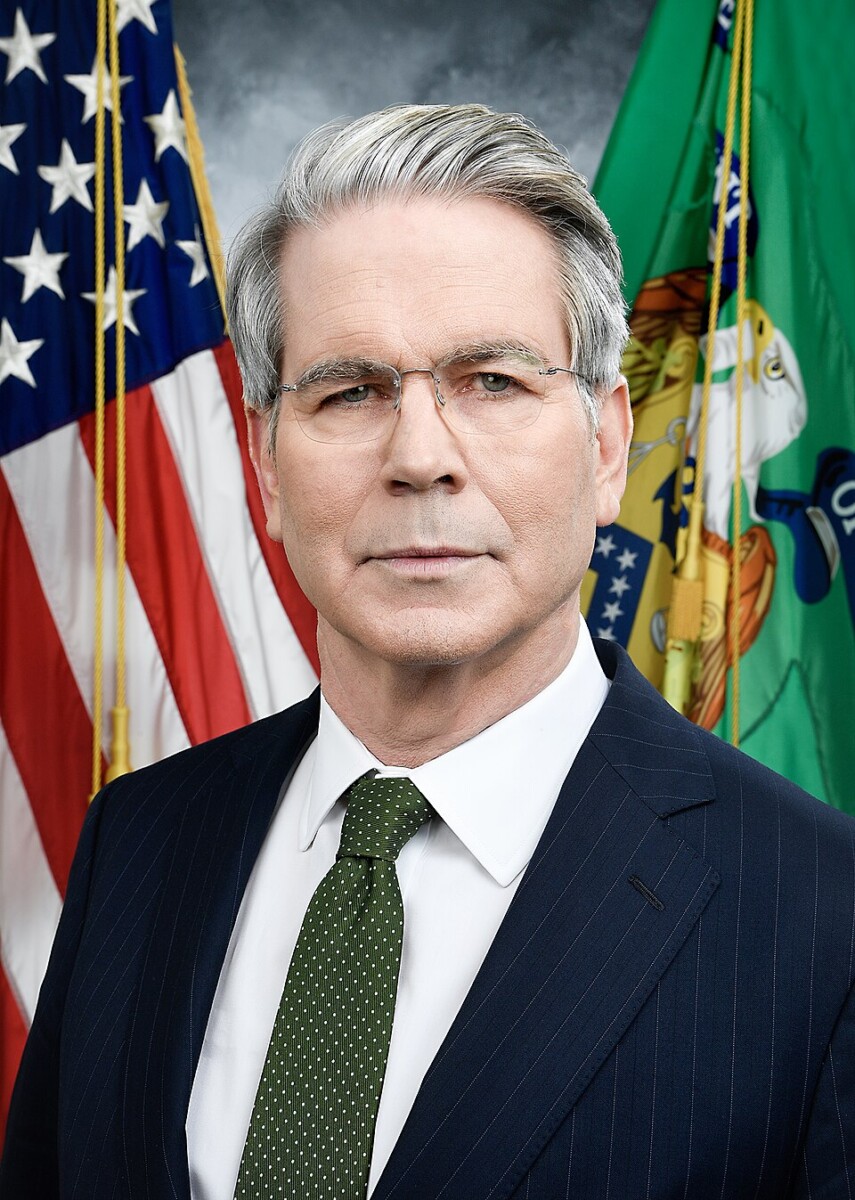

The announcement was formally conveyed by U.S. Treasury Secretary Scott Bessent via the social media platform X. Secretary Bessent articulated that “the Treasury is currently in negotiations with Argentine officials for a $20 billion swap line with the Central Bank.”

He further delineated the administration’s comprehensive support, stating the U.S. Treasury stands “ready to purchase Argentina’s USD bonds and will do so as conditions warrant.”

This intervention represents a profound vote of confidence in the economic reforms championed by President Milei, a staunch political ally of President Trump. The administration’s support extends beyond the swap line, with Secretary Bessent detailing readiness to “deliver significant standby credit via the Exchange Stabilization Fund,” a potent financial instrument last deployed during the 1995 Mexican peso crisis.

This proactive approach demonstrates the Trump administration’s commitment to deploying America’s economic strength to support allied nations pursuing liberty-oriented policies.

President Milei promptly acknowledged the gesture, expressing gratitude on X: “Thank you President Trump and Secretary Bessent for your firm support and confidence in the Argentine people. Together we will build a path to stability, prosperity and freedom.”

Analysts at CWEB Business News view this development as a critical lifeline extended to the libertarian leader. Argentina, plagued by protracted economic crises, faces pivotal midterm elections, and President Milei’s political fortunes are inextricably linked to demonstrating tangible economic progress. The market response was immediately favorable; the Argentine peso appreciated significantly, and the Merval stock index surged approximately 5 percent in dollar terms following the news.

This strategic partnership also carries significant geopolitical implications. Argentina maintains an existing $18 billion swap line with the People’s Bank of China, of which only $5 billion is currently active. Senior Trump administration officials have previously criticized this arrangement. CWEB analysts suggest that a potential condition for continued U.S. support may involve a recalibration of Argentina’s financial dependencies, effectively countering Chinese economic influence in the Western Hemisphere. The administration’s firm support is poised to empower President Milei, contingent upon warranted conditions, to navigate both economic recovery and the upcoming electoral challenge.

#EconomicDiplomacy #TrumpAdministration #Argentina #Milei #ForeignPolicy #FinancialMarkets #LatinAmerica #CWEB @realDonaldTrump @JMilei @SecBessent @cweb