Conagra Brands, Inc. (NYSE: CAG) Board of directors approved a quarterly dividend payment of $0.2125 per share of CAG common stock to be paid on June 3, 2020 to stockholders of record as of the close of business on April 30, 2020.

Conagra Brands, Inc. (NYSE: CAG) Board of directors approved a quarterly dividend payment of $0.2125 per share of CAG common stock to be paid on June 3, 2020 to stockholders of record as of the close of business on April 30, 2020.

Tip Ranks reports “Based on 8 analysts offering 12-month price targets for Conagra Brands in the last 3 months. The average price target is $36.17 with a high forecast of $41.00 and a low forecast of $32.00.[i]

Conagra owns many of the iconic brands we see in supermarkets around the world. The company is always offering new products in the food industry to keep up with consumer demand.

Jeffries and Co. has upgraded Conagra because people eating at home more and spending more on items that Conagra sells. Due to the pandemic many have lost their jobs and need to economize. They will not be spending their funds on eating out as often, therefore benefiting Conagra Foods.

Mr. Sean M. Connolly is President and Chief Executive Officer of Conagra Brands. Prior to joining Conagra Brands, Mr. Connolly was President and CEO of The Hillshire Brands Company. Mr. Connolly also held a position as CEO for Sara Lee North American Retail and Food service, as well as President of Campbell Soup North America.[ii]

Top Institutional Holders

Holder Shares Date Reported % Out Value

Vanguard Group, Inc. (The) 58,610,204 Mar 30, 2020 12.03% 1,719,623,385

Blackrock Inc. 40,450,150 Mar 30, 2020 8.30% 1,186,807,401

Capital World Investors 38,056,615 Mar 30, 2020 7.81% 1,116,581,084

Price (T.Rowe) Associates Inc 29,996,118 Mar 30, 2020 6.16% 880,086,102

Macquarie Group Limited 29,156,361 Mar 30, 2020 5.99% 855,447,631

State Street Corporation 21,866,481 Mar 30, 2020 4.49% 641,562,552

Top Mutual Fund Holders

Holder Shares Date Reported % Out Value

Delaware Group Equity Funds II- Value Fund 13,750,024 Feb 28, 2020 2.82% 366,988,140

Vanguard Total Stock Market Index Fund 13,688,139 Dec 30, 2019 2.81% 468,681,879

American Balanced Fund 13,612,296 Mar 30, 2020 2.79% 399,384,764

Vanguard Mid-Cap Index Fund 12,527,259 Mar 30, 2020 2.57% 367,549,779

Fundamental Investors Inc 11,484,805 Mar 30, 2020 2.36% 336,964,178

Vanguard 500 Index Fund 10,014,368 Mar 30, 2020 2.06% 293,821,557

Price (T.Rowe) Equity Income Fund 8,760,000 Mar 30, 2020 1.80%

[i] https://www.tipranks.com/stocks/cag/price-target

[ii] https://www.conagrabrands.com/our-company/corporate-leadership/sean-connolly

[object HTMLElement]

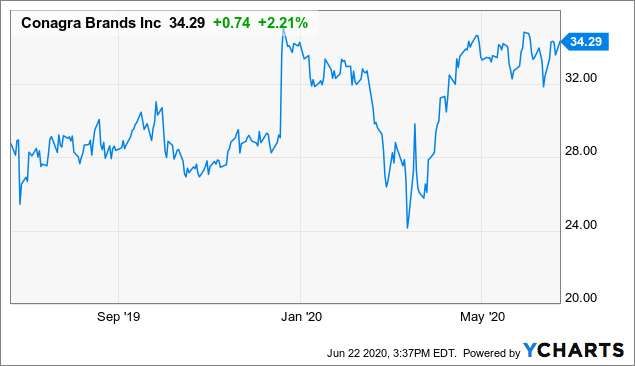

Conagra was up 2.2%, to $34.29 Monday morning, while Campbell was up 0.8%, to $49.52. Barron’s has made much the same argument in recent weeks 257,018,400

Credit Suisse set a target price of $36 for Conagra, up from the company’s price of $33.33 on June 15. Mr. Moskow said faster-than-expected deceleration of at-home food consumption from the easing of social distancing restrictions represents the biggest downside risk to Credit Suisse’s target price for Conagra.

CWEB Analysts see the stock as a potential for long term growth and a great addition to one’s portfolio and upward of $60 by 20121

CWEB.com is not registered as an investment adviser with the U.S. Securities and Exchange Commission. Rather, CWEB.com relies upon the “publisher’s exclusion” from the definition of investment adviser as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws.