The semiconductor industry is experiencing a notable decline as ASML, a leading supplier of photolithography equipment, lowers its sales forecast. This development raises concerns about the future of chip stocks, particularly in light of the potential for U.S. restrictions on AI chip exports.

ASML’s Forecast Cut: Implications for the Industry

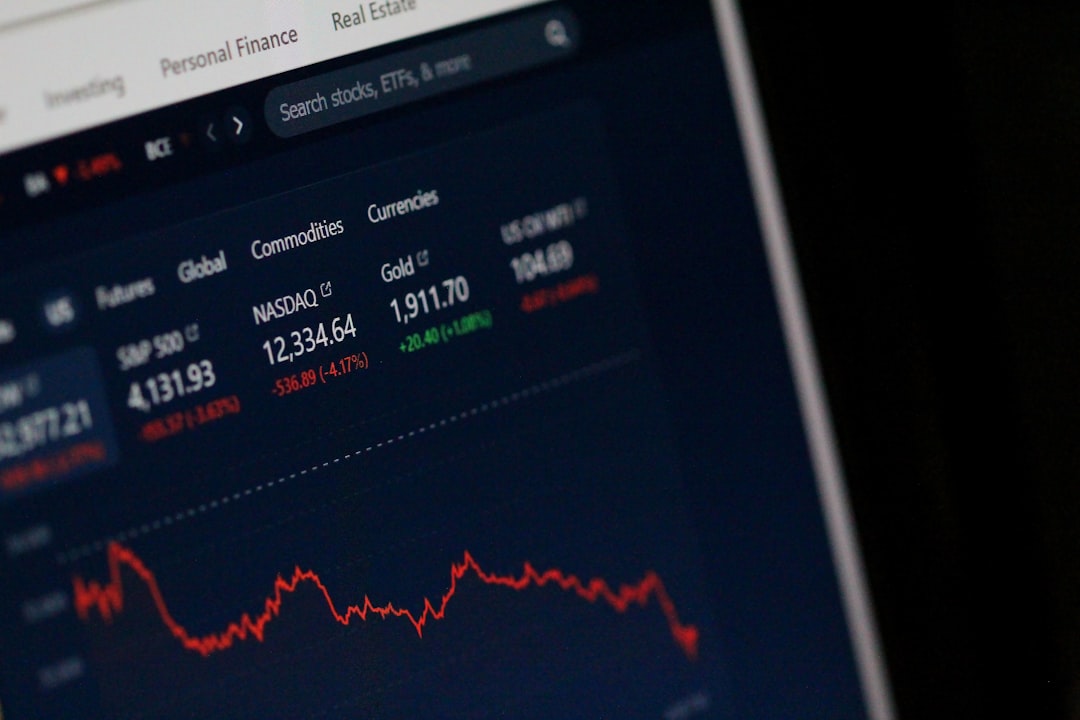

ASML recently announced a significant reduction in its sales forecast, attributing the decision to sluggish demand from major clients. The company’s updated outlook has sent ripples through the semiconductor sector, leading to declines in share prices for various chip manufacturers. As one of the key players in the industry, ASML’s performance often serves as an indicator for the health of the broader semiconductor market.

Potential U.S. Export Restrictions on AI Chips

Compounding the situation are discussions surrounding potential U.S. restrictions on AI chip exports. These measures could have far-reaching implications, impacting not only chip manufacturers but also technology companies reliant on advanced semiconductor technology for their operations.

Investor Sentiment: The prospect of export restrictions may lead to increased volatility in the chip stocks as investors weigh the potential impact on revenue and growth prospects. Concerns over supply chain disruptions and reduced market access are likely to weigh heavily on investor sentiment.

Market Reactions: Following ASML’s forecast cut, shares of companies like NVIDIA and AMD have seen declines, reflecting a broader market reaction to the news. Investors are closely monitoring these developments to assess the potential for further declines in stock prices.

Looking Ahead: The Future of Chip Stocks

The outlook for chip stocks remains uncertain as industry players navigate the challenges posed by ASML’s forecast cut and potential regulatory changes. Analysts are urging caution, highlighting the importance of watching demand trends and geopolitical developments in the coming months.

API Insights: Chip Market Trends

For those interested in tracking chip market trends and performance metrics, consider exploring the Technical Intraday (Williams) API, which provides real-time technical analysis of various stocks, including chip manufacturers. Additionally, the Key Metrics (TTM) API offers insights into the key financial metrics that can help investors make informed decisions.

Conclusion

As the semiconductor industry grapples with ASML’s revised forecast and potential U.S. export restrictions, investors must stay vigilant. The dynamics of the market are shifting, and understanding these developments will be crucial for navigating the evolving landscape of chip stocks.