Bilibili Inc. (NASDAQ:BILI) reported a Q2 loss of $0.09 per share, beating the Zacks Consensus Estimate by $0.01.

The company showcased a significant revenue of approximately $6.13 billion, indicating a strong business model.

Despite a net income loss of around $609 million, Bilibili’s strategic investments in content and technology highlight its growth potential.

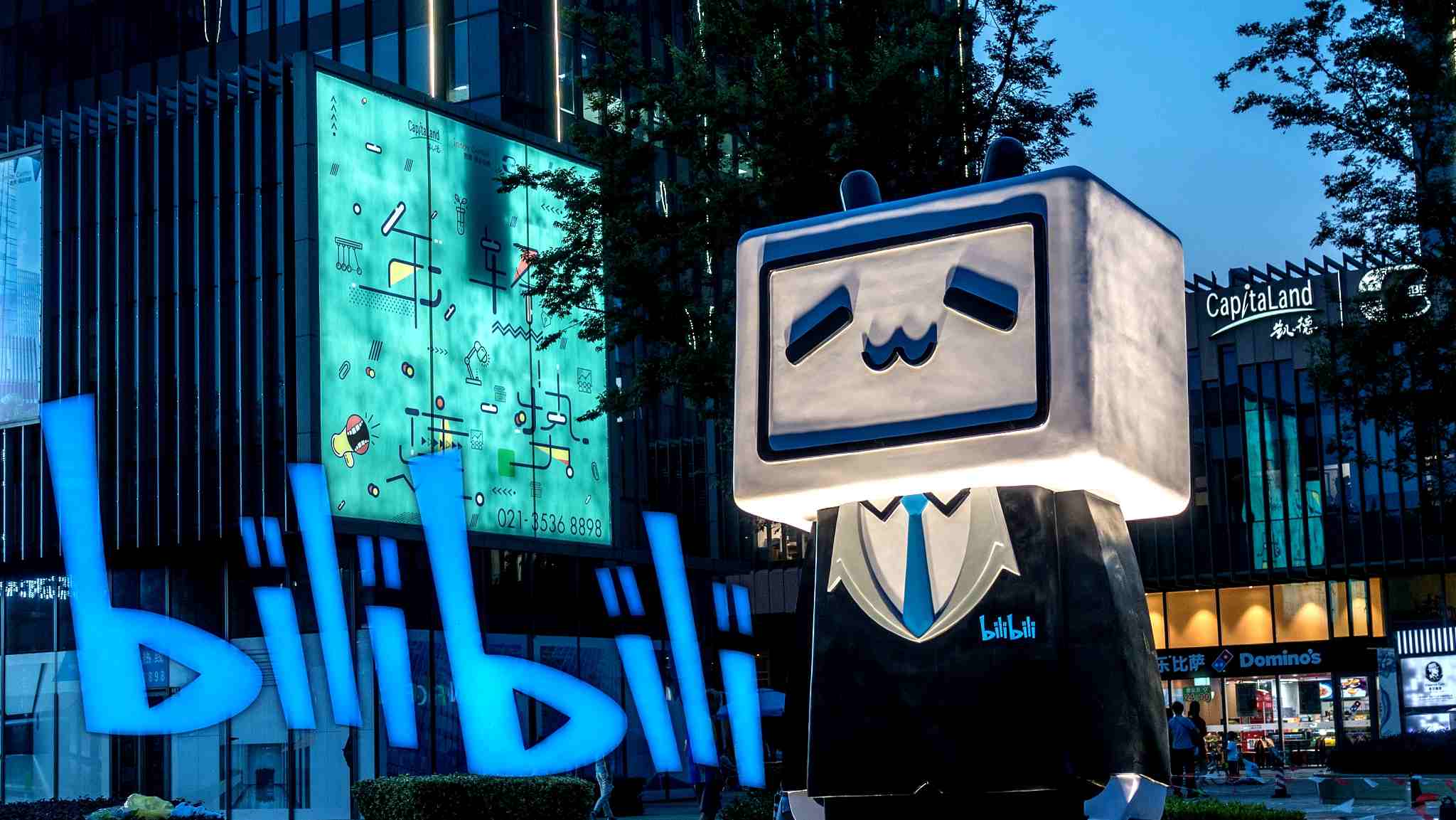

Bilibili Inc. (NASDAQ:BILI), a prominent player in the Chinese online entertainment sector, recently disclosed its financial outcomes for the second quarter, showcasing a loss of $0.09 per share. This figure slightly outperformed the expectations set by the Zacks Consensus Estimate, which had predicted a loss of $0.10 per share. This performance is a notable improvement compared to the same period last year, where Bilibili reported a loss of $0.33 per share. Such an improvement is a clear indicator of Bilibili’s strengthening financial health and its potential trajectory towards profitability.

The company’s financial report highlighted a quarterly revenue of approximately $6.13 billion, underlining a robust business model despite the reported losses. This revenue figure is crucial as it demonstrates Bilibili’s ability to generate significant sales from its diverse range of services, including mobile gaming, live broadcasting, and video hosting. The gross profit of about $1.83 billion further emphasizes the company’s efficient cost management and operational effectiveness.

However, Bilibili faced a net income loss of around $609 million and an operating income loss of approximately $585 million. These figures, although indicative of current financial challenges, must be viewed in the context of the company’s growth strategy and investment in content and technology to capture a larger market share. The reported EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of roughly $97.46 million provides a glimpse into the company’s underlying operational performance, excluding non-cash expenses and tax considerations.

The cost of revenue, standing at about $4.29 billion, reflects the significant investment Bilibili makes in content creation and licensing, a critical component of its business model. Despite these substantial costs, the company’s strategic focus on content diversification and user engagement continues to drive its revenue growth. The earnings per share (EPS) of -1.46, although indicating a loss, must be interpreted in the light of the company’s long-term growth potential and ongoing investments in expanding its user base and content portfolio.

In summary, Bilibili’s latest financial report reveals a company in the midst of a strategic expansion, investing heavily in content and technology to solidify its position in the competitive online entertainment industry. Despite the reported losses, the positive trend in its financial performance and the substantial revenue generation point towards a promising future for Bilibili as it continues to evolve and adapt in a rapidly changing digital landscape.