Introduction

Jack Ma-backed Ant Group has reportedly developed new techniques to train AI models at a 20% lower cost, using Chinese-made semiconductors instead of relying solely on NVIDIA Corporation’s (NASDAQ: NVDA) AI chips. According to Bloomberg, the breakthrough was achieved using chips from Alibaba Group (NYSE: BABA) and Huawei Technologies, signaling China’s growing shift towards domestic AI hardware solutions.

Key Highlights

Ant Group’s AI Training Breakthrough

Developed new cost-efficient AI model training techniques.

Achieved results comparable to NVIDIA’s H800 chips.

Training costs could be cut by up to 20%.

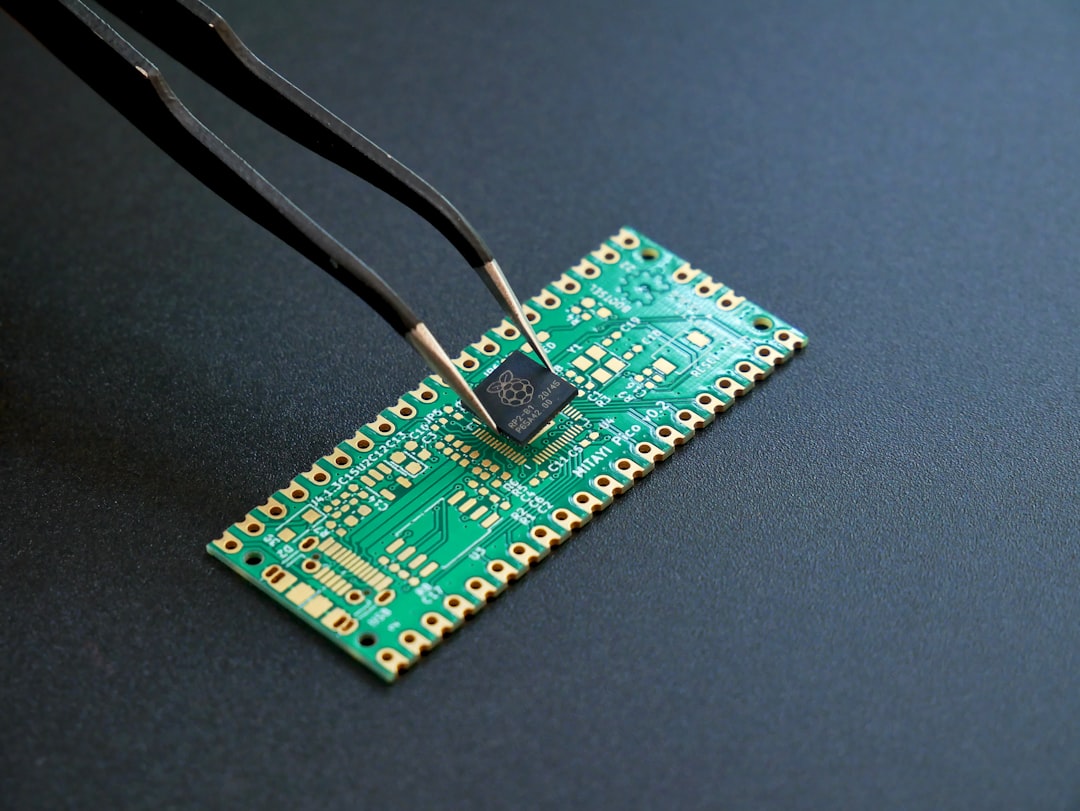

Use of Chinese-Made Chips

Leveraging Alibaba and Huawei’s semiconductors.

Exploring Advanced Micro Devices (NASDAQ: AMD) chips as an alternative.

Part of a broader strategy to reduce reliance on U.S. chipmakers.

Impact of U.S. Chip Restrictions

Biden administration’s trade curbs blocked China from acquiring advanced AI chips.

Despite restrictions, DeepSeek R1, released in January, matched OpenAI’s ChatGPT while using older hardware and lower costs.

The Bigger Picture: China’s AI Self-Sufficiency

1. Rising Domestic Alternatives to U.S. AI Chips

Ant Group’s breakthrough aligns with China’s broader push for AI self-sufficiency after U.S. trade restrictions. While Nvidia still dominates global AI chip development, Chinese firms like Huawei, Alibaba, and Baidu are ramping up their AI chip capabilities.

2. Impact on Global AI Chip Market

If Chinese firms successfully replace NVIDIA’s chips, it could:

Lower China’s dependence on U.S. semiconductor giants.

Intensify competition in AI chip innovation.

Drive further geopolitical tensions over semiconductor technology.

3. Potential Challenges

Chinese AI firms still rely on some U.S. chips for cutting-edge developments.

Domestic alternatives may take time to fully replace NVIDIA’s advanced technology.

The U.S. could further tighten trade restrictions in response to China’s advancements.

Investor Implications

For those tracking AI chip developments, key stocks to watch include:

NVIDIA (NASDAQ: NVDA) – Market leader facing increased competition in China.

Alibaba (NYSE: BABA) – Strengthening its AI and semiconductor presence.

Advanced Micro Devices (NASDAQ: AMD) – Potential alternative supplier for Chinese AI firms.

Huawei (Privately held) – A key player in China’s AI hardware ecosystem.

For deeper insights into these companies’ financials, investors can leverage:

Balance Sheet Statements API – Analyze the financial health of companies investing in AI chips.

Company Rating API – Track market sentiment on AI chip manufacturers.

Conclusion

Ant Group’s breakthrough in AI training with Chinese-made chips marks a major step toward China’s semiconductor independence. While the U.S. remains a leader in AI hardware, Chinese firms are proving resilient, developing cost-effective alternatives despite trade restrictions.

Investors should closely watch developments in the AI chip race, as they could reshape the global tech and semiconductor landscape in the coming years.