Earnings per Share (EPS) fell short of expectations at -$0.05149, missing the estimated EPS of $0.04.

Reported revenue was approximately $26.85 million, below the expected $37.9 million.

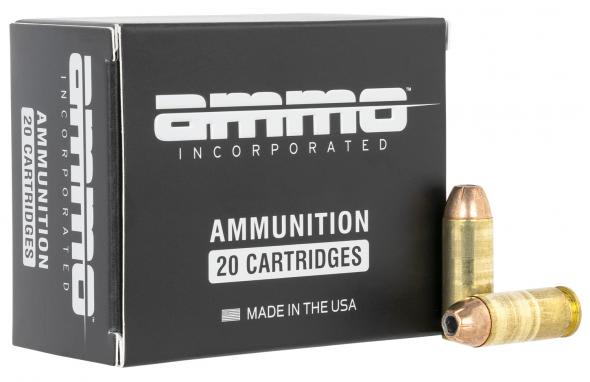

Despite challenges, AMMO, Inc. demonstrated notable progress in the sales of rifle ammunition and casings throughout the fiscal year 2024.

AMMO, Inc. (NASDAQ:POWW), a key player in the leisure and recreation products industry, recently disclosed its financial results for the fourth quarter and fiscal year 2024, which concluded on March 31, 2024. The company, known for owning GunBroker.com, the largest online marketplace for firearms and shooting sports industries, and for being a vertically integrated producer of high-performance ammunition and components, reported earnings that fell short of expectations. Specifically, AMMO, Inc. revealed an earnings per share (EPS) of -$0.05149, missing the estimated EPS of $0.04, and reported revenue of approximately $26.85 million, which did not meet the expected revenue of $37.9 million.

The company’s performance in the quarter ending March 2024 showed a decline from the previous year’s earnings of $0.03 per share to $0.01 per share, marking a significant earnings surprise of -75%. This contrasted sharply with the previous quarter, where AMMO, Inc. had a positive earnings surprise of 100%, posting earnings of $0.04 per share against an expected $0.02. Despite the disappointing earnings, AMMO, Inc. managed to achieve revenues of $40.42 million for the quarter, surpassing the Zacks Consensus Estimate by 7.50%. However, this still represented a decrease from the revenue of $43.68 million reported in the same period a year ago.

Throughout the fiscal year 2024, AMMO, Inc. demonstrated notable progress, especially in the sales of rifle ammunition and casings. The company’s CEO, Jared Smith, highlighted the sequential increase in sales despite a challenging market environment. This growth was attributed to strategic initiatives, including the enhancement of GunBroker.com’s capabilities and the fulfillment of the ZRO Delta contract, underscoring AMMO’s commitment to improving its product offerings and market presence.

Moreover, AMMO, Inc. has been actively pursuing financing and cross-selling opportunities, aiming to strengthen its financial position and expand its customer base. The company’s focus on developing a robust pipeline of products and services is evident in its strategic decisions and operational achievements throughout the fiscal year. Despite the setbacks in the latest earnings report, AMMO, Inc. remains dedicated to advancing its market presence and financial health.

Currently, AMMO, Inc. is trading at $2.51, experiencing a slight increase of $0.02 or approximately 0.80%, from its previous close. The stock has fluctuated between a low of $2.4552 and a high of $2.54 during the trading session, with a market capitalization of approximately $297.84 million. This trading activity reflects the market’s response to the company’s financial performance and strategic initiatives.